!Gawaxab says economy has turned the corner – Domestic growth is anticipated to pick up in 2023

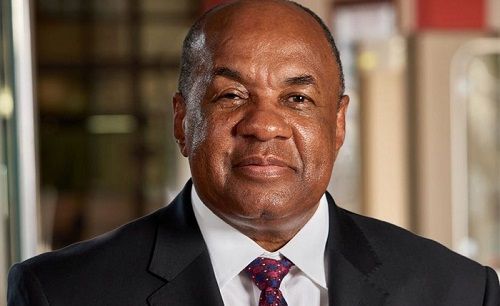

The central bank governor, Johannes!Gawaxab recently said that Namibia’s economy has turned the corner and the bleak period marred by contractions is over after the economy suffered negative growth between 2016-2020.

For a second consecutive year, the economy is forecast to grow by 3,2% in 2022, sustaining the positive growth of 2.7% registered in 2021, !Gawaxab said during a stakeholder engagement in the Oshana region, which included several local authorities and business leaders

The governor gave an overview of the state of the global and domestic economy and said that while a recession is anticipated globally, domestic growth is anticipated to pick up in 2023.

“The titanic is shifting towards a more positive territory” enthused the Governor. He

went to state that monetary stability is the best contribution the Bank of Namibia can make in the long run to contribute towards high levels of employment and sustained economic development for the country as the country exits a gloomy period worsened by the worst contraction in history because of the Covid-19 pandemic which wiped out socio-economic gains and caused massive job losses in key industries.

“The role of the central bank of safeguarding macroeconomic stability is becoming more pronounced,’’ the Governor stated in light of inflationary pressures which have been building up since the beginning of the year. Namibia’s inflation averaged 2.2% in 2020 and 3.6% in 2021. During this period, crude oil prices were low, particularly due to Covid-related travel restrictions. Inflation is expected to average 6.1% due to international fuel prices and food prices owing to the conflict between Russia and Ukraine and supply chain disruptions.

“The best thing a central bank can do for any economy is to prevent it becoming the major source of economic disturbance, as the renowned economist Milton Friedman once said. As the monetary authority, we can not shy away from our responsibility to fight inflation within the confines of and effectiveness of the instruments at our disposal.”

According to!Gawaxab for this reason, Namibians need to fully appreciate the Bank’s role in monetary policy as a means of keeping inflation under control.

“The Bank’s Monetary Policy Committee (MPC) adopted an ultra-accommodative monetary policy in 2020 and kept the Repo rate at a record-low level through to early 2022. The MPC of the Bank increased the repo rate to 6.25 in October 2022 from 5.50 in August 2022,” he added.

“Namibia is a country with credible plans and opportunities. Our fortunes are turning, and the central bank is committed to ensuring price stability to provide a foundation for sustained economic recovery and sustainable economic development going forward,” he concluded.