Foreign direct investment off to a promising start in 2021 – Experts

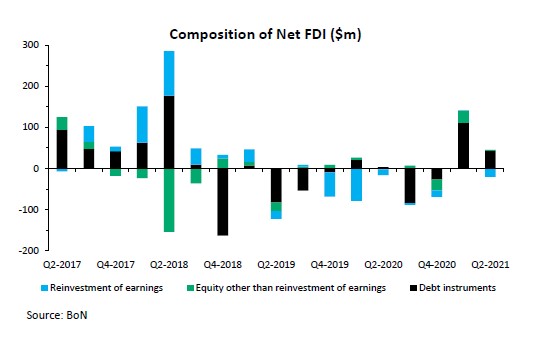

The cumulative net foreign direct investment (FDI) inflows in the first half of 2021 were N$166 million, which is the best first-half performance since 2018.

The Bank of Namibia ascribes this improvement to the increase in loans granted to domestic subsidiaries by their non-resident parent companies, particularly those in the mining industry.

Almost 61% of Namibia’s FDI stock is in mining & quarrying, nearly 24% is in financial services, and about 6% is in manufacturing. The countries with the biggest shares of the FDI stock are China (42.7%), followed by South Africa (31.2%) and Mauritius (8.3%).

The latest figures from the central bank show that FDI recorded an inflow of N$25 million in the second quarter of 2021 compared to a net outflow of N$13 million during the same period last year.

According to PSG Namibia’s research analyst, Shelly Louw, FDI is off to a promising start in 2021 following a sharp downturn in FDI inflows which started in 2015.

“The depressing period for FDI inflows between 2015 and 2020 was marked by a general decline in commodity prices, weakening emerging market sentiment, a slowdown in FDI flows globally, and uncertainty surrounding government policies,” Louw said.

However, Louw added, the strong recovery in global commodity prices since the second half of 2020, especially those of diamonds, uranium, zinc, copper, and tin, which are abundant in Namibia has reinvigorated mining investment.

“Next year will see the arrival of Debmarine Namibia’s new 468 m diamond mining vessel (AMV 3) while other planned revival or expansion projects for gold, zinc, copper and tin mining also bode well for mining investment in the medium term,” Louw added.

PSG’s projection is for net FDI to improve to N$118 million in 2021.

“However, based on the stronger than expected FDI inflows in the first half of 2021 and upward revisions to our global commodity price assumptions, we will raise our current net FDI projection for the short to medium term during the next forecast round,” Louw said.