Central Bank cuts repo rate by 100 basis points to 5.25%

The Bank of Namibia has taken a crisis repo rate decision, cutting the interest rate by 1 percentage point from 6.25% to 5.25%, similar to decisions by the South African Reserve Bank and other central banks.

Central Bank Governor, Iipumbu Shiimi announced this on Friday, stating the bold decision was taken to stimulate growth and cushion the anticipated negative effects of COVID-19.

“This was also done in order to counter deteriorating financial conditions. These were accompanied by fiscal stimulus in most of the affected economies in the world,” Shiimi said.

Since the last monetary committee meeting held on 19 February, financial markets and in particular equity markets recorded significant losses as risks and uncertainty increases, and according to Shiimi, Namibia’s economy may not be spared from the brunt of COVID-19 and may therefore continue to weaken in 2020.

Shiimi said during the first two months of 2020, domestic activity has slowed, mainly in sectors such as mining, wholesale and trade, as well as tourism while activity in transport and construction improved during the period.

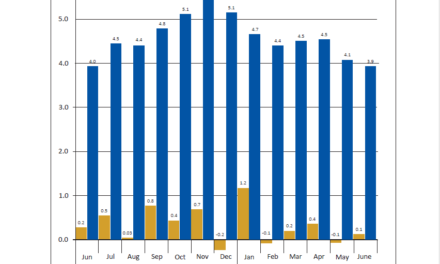

Inflation further declined during the first two months of 2020 to 2.3% from 4.5% last year, mainly on account of a decline in food and non-alcoholic beverages, housing and transport inflation.

Shiimi further shared that crude oil prices declined significantly, reinforcing the effects of excess oil supply.

“While the low crude oil prices may negatively impact oil exporting countries, it could bring some relief to oil importing countries such as Namibia,” Shiimi said.

Furthermore, as at 29 February, the stock of international reserves stood at N$32.2 billion, from N$31 billion reported in the 19 February monetary policy meeting.

Shiimi said this amount is estimated to cover 4.6 months of imports, sufficient to protect the peg of the Namibia Dollar to the South African Rand and meet the country’s international financial obligations.