Narrower external deficit masks economic despair

By Gerrit van Rooyen

Oxford Economics.

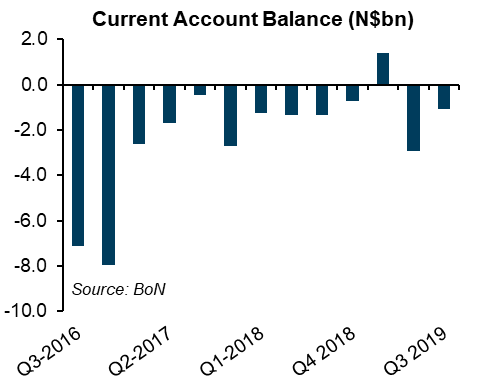

The current account deficit narrowed in Q3 2019 compared to the same quarter in 2018, but this belies an economy that remains deep in depression. The narrowing of the external deficit stemmed mainly from lower imports of fuel, vehicles, and machinery, which reflects weak domestic economic activity and lower global oil prices. Meanwhile, exports of diamonds and tourism revenues were especially disappointing.

The goods trade deficit narrowed to N$5.6 billion in Q3 2019 from N$6.1 billion in Q3 2018 thanks to the import bill declining more than the reduction in export receipts during this period. The value of fuel (-12% y-o-y),vehicle (-21% y-o-y), and machinery (-18% y-o-y) imports fell the most, largely reflecting an economy which is on track to record the sharpest contraction since at least 1993, while the average Brent crude oil price was also lower in Q3 2019 relative to a year earlier.

The decline in imports offsets the slump in diamond exports (-36% y-o-y) as well as significant declines in food and live animal (-23% y-o-y) and processed fish (-5% y-o-y) exports. The slide in exports was mitigated by an increase in ‘other’ minerals products (16% y-o-y) thanks to improved exports of gold and zinc.

Namibia continues to source most of its goods imports from South Africa (67%), followed by China and the eurozone. The country mainly imports fuel, vehicles, and machinery from South Africa. Namibia’s leading export partners are the eurozone (26%), followed by South Africa (25%), Botswana (14%), and China (11%).

Exports to the eurozone consisted mostly of beef, processed fish and diamonds. Looking at non-goods trade, Namibia’s services account recorded net outflows of N$481 million during Q3 2019 compared to net inflows of N$850 million during the same period last year. The subcategory that declined the most in the services account was personal travel services (a proxy for foreign tourism earning), reflecting a decline in intentional arrivals.

Meanwhile, net primary income inflows of N$234 million were recorded inQ3 2019 compared to outflows of N$585 million in Q3 2018. The positive balance on the primary income account is mainly due to an increase in investment income, particularly income on reserve assets and portfolio investment. Lastly, current transfer rose to a surplus of N$4.8 billion Q3, largely thanks to an 8.9% y-o-y increase in Southern African Customs Union receipts.

The De Beers rough diamond auctions in Q4 2019 continued to disappoint, which indicates that Q4 will be another dismal quarter for diamond exports. Food exports, which are suffering due to drought and depleted livestock and fish population numbers, are also unlikely to bounce back in the near term.

To make matters worse, the closure of the Skorpion zinc refinery from November 2019 to February 2020 will hit zinc exports, one of the few bright spots in the current account, in Q4 2019 and Q1 2020. On the other hand, continued weak economic activity and lower oil prices compared to 2018 will keep the import bill in check. Hence, we expect the country will record another current account deficit in Q4, which will be a drain on foreign reserves. However, we do not expect the decline in reserves to be significant enough to place pressure on the sovereign credit rating or the currency regime.