South Africa reduces its repo rate by 25 basis points to 6.5%

The South African Reserve Bank on Thursday announced a 25 basis point cut in the repo rate, bringing it down to 6.5% from the previous 6.75%, citing weak demand, a lack of business confidence and the strong decline in quarterly GDP, as the main concerns.

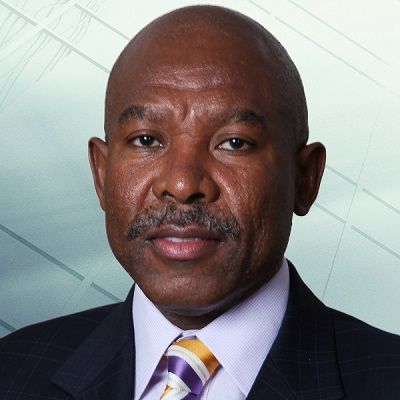

At the announcement of the Monetary Policy Committee’s resolution, SARB Governor, Lesetja Kganyago indicated that future interest rate adjustments for the remainder of 2019 can go in any direction although earlier, the bank only anticipated one rate cut in 2019.

Namibia and South Africa follow a synchronised, coordination monetary policy although the two countries’ rate are not necessarily the same. For the past two and a half years, however, the rates were exactly the same most of the time. Namibia’s current repo rate is 6.75%.

The next MPC meeting of the Bank of Namibia is scheduled for Wednesday 14 August when it is widely expected that the committee will follow the example of their South African counterparts and also announce a 25 basis point cut.

On growth in South Africa, Kganyago said the “SARB now expects GDP growth for 2019 to average 0.6% (down from 1.0% in May). The forecast for 2020 and 2021 is unchanged at 1.8% and 2.0% respectively.”

Passing the economic buck to the South African government, Kganyago continued “While some cyclical factors constrained recent GDP growth outcomes, the Committee remains of the view that current challenges facing the economy are primarily structural in nature and can not be resolved by monetary policy alone. Implementation of prudent macroeconomic policies together with structural reforms that raise potential growth and lower the cost structure of the economy remains urgent.”

The governor noted the sharp economic contraction of the first quarter of 2019, saying “In the domestic economy, GDP contracted in the first quarter due to a combination of supply-side and demand-side factors.

“GDP contracted by 3.2% in the first quarter, reflecting weakness in most sectors of the economy. The sharp quarterly decline was primarily caused by electricity shortages and strikes that fed into broader weakness in investment, household consumption and employment growth. Based on recent short term indicators for the mining and manufacturing sectors, a rebound in GDP is expected in the second quarter of 2019,” he said adding that the continued low business confidence remains a concern for the MPC.

Expressing his institution’s positive view of recent declining inflation trends, he said “Monetary policy actions will continue to focus on anchoring inflation expectations near the mid-point of the inflation target range in the interest of balanced and sustainable growth. In this persistently uncertain environment, future policy decisions will continue to be highly data dependent, sensitive to the assessment of the balance of risks to the outlook, and will seek to look through temporary price shocks.”

Since the May MPC, the rand has appreciated by 3.3% against the US dollar, by 2.4% against the euro, and by 2.3% on a trade-weighted basis. The SARB sees the Rand as slightly undervalued implying a steady but limited appreciation over the next three months.

“Against this backdrop, the MPC unanimously decided to reduce the repurchase rate by 25 basis points to 6.5% per annum with effect from 19 July 2019,” stated the governor.

The next statement of the South African Monetary Policy Committee will be released on 19 September 2019.