Funding Africa’s infrastructure gap

Key to enabling African economies to make the most of their opportunities is developing infrastructure in the region. Across the continent, new laws are being implemented and alternative sources of infrastructure funding are being sought in order to kick-start direly needed infrastructure projects.

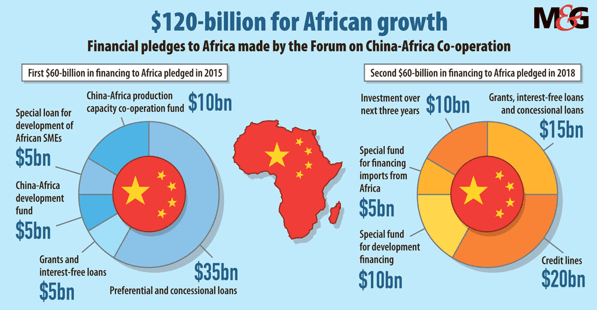

At the centre of it all is China, which is providing alternative sources financing to countries in Africa that have not been able to access funding in more traditional ways. The benefits are numerous, but African countries are also concerned about their growing dependence on China.

Research released in 2018 from Baker McKenzie and IJGlobal (research) with data drawn exclusively from fully financed projects and excluding recent announcements of government funding commitments, shows that the value of loans from Chinese financing of energy and infrastructure projects in Africa almost trebled between 2016 and 2017, from US$3 billion to US$8.8 billion.

“As China’s Belt and Road Initiative (BRI), a multi-billion dollar plan to link Asia, Europe and Africa, is actively being implemented, we expect this amount will increase even further in the coming years,” said Wildu du Plessis, Head of Banking & Finance at Baker McKenzie in Johannesburg.

According to the research, Chinese banks have been active lenders to infrastructure projects in 19 different countries in Africa in the past four years. Infrastructure projects in Ethiopia have received US$1,8 billion since 2014, Kenyan projects US$4,8 billion, Mozambique infra deals US$1,6 billion and Nigerian projects US$5 billion from Chinese lenders. South African infrastructure projects have received US$2,2 billion from Chinese lenders since 2014, Zambia has received US$1.5 billion and Zimbabwe has seen US$1.3 billion in loans from Chinese policy lenders since 2014.

As one of South Africa’s largest trading partners, China plays an important role in infrastructure investment in this country too. At the BRICS Summit Energy in 2018, China pledged to invest USD 14.7bn in South Africa and to grant loans to state owned enterprises Eskom and Transnet.

Du Plessis noted that even though the South African infrastructure funding gap is not as severe as other countries in Africa, there is a still difficulty in mobilising funds for infrastructure development and related projects because traditional funders take time to decide on whether to get involved.

Stanley Jia, Partner in the Beijing Office of Baker McKenzie, notes, “As part of the mobilisation of different sources of funding to fill the infrastructure gap, there is a big bucket of Chinese funding that can be used for infrastructure projects in Africa. The increasing appetite from China for funding infrastructure projects as part of its BRI means they are happy to partner with local development finance institutions and other international funders.”

According to Kieran Whyte, Head of Energy, Mining & Infrastructure at Baker McKenzie in Johannesburg, “A big attraction of the BRI for both African governments and project sponsors is that it assists the speed of project implementation. Project stakeholders advise that the whole process is a lot quicker than other options.”

Jia notes that, “Chinese policy lenders also assist in providing liquidity in that they are willing to negotiate with countries that have financial constraints that deny them access to traditional capital.”

Du Plessis notes, however, that there is rising concern amongst African sovereigns who are worried about the long term effects on their dependence on China.

“This is even though China has reiterated that it wants to be considered a responsible investor in Africa. It remains to be seen whether this concern has an impact on Chinse involvement in the funding infrastructure projects in future years. African countries have also begun building capacity to correct the imbalance between borrowers and lenders in the negotiation phase so that more balanced agreements can be reached,” he explains.

Khaled Abou El Houda, Managing Partner of Houda Law Firm in Senegal and Côte d’Ivoire, notes, “Senegal became a BRI partner with China after the two countries signed bilateral deals during Chinese President Xi Jinping’s West Africa trip in late July 2018.

“In addition to plans for improving infrastructure in Senegal, China promised to support the country with anti-terror, peacekeeping and maintaining social stability. However, while the BRI has provided many opportunities for development, the general consensus is the China-Africa relationship could be placed on more equal footing. The challenge for Africa is in establishing where its interests converge with China’s, where they diverge, and how areas of convergence can be shaped to advance African development priorities,” he says.

Houda explains that in order to help fund the infrastructure gap, the Senegalese government adopted the Plan Senegal Emergent (PSE) in 2014, with the overall aim of boosting the economy.

“We saw encouraging signs of 6.8% real GDP growth one year after the PSE’s implementation and it has maintained more than 6% growth in subsequent years. Building on this success, the government is continuing its PSE implementation and related reforms, targeting sectors such as energy, transport infrastructure and agriculture.”

In Zimbabwe, Thomas Chagudumba, of Atherstone & Cook notes that the infrastructure funding gap is being addressed in various ways. Funding comes through government floating infrastructure bonds, Public Private Partnerships (PPPs) and off-budget loan funding. Khumalo notes that policy consistency, particularly in respect of currency convertibility, exchange control regulations on repatriation of funds and improved transparency and accountability are all essential to encourage infrastructure funding in Zimbabwe.

Further, he explains that it is important to ring fence resources, including foreign currency, for critical inputs in support of ongoing works. This can be done via undertakings from the Reserve Bank of Zimbabwe and government guarantees. Construction and performance bonds could also be used to curb poor project implementation, mismanagement and corruption in the infrastructure sector.

Chagudumba notes that Zimbabwe has also benefited from the BRI with major projects in Zimbabwe including the Kariba South Hydro Power Station and the Victoria Falls International Airport.

“For Zimbabwe, the benefits of the BRI include that it aids in infrastructure development, which in turn benefits economic expansion. The transfer of information and expertise and employment creation are further benefits.”

Mauritius does not have a large infrastructure funding gap as compared to other jurisdictions in Africa, explains Moorari Gujadhur, a barrister at Madun Gujadhur Chambers in Mauritius. “Infrastructure projects in Mauritius tend to focus on either improving current infrastructure (ie large grid separated flyovers) or to introduce new projects (ie light rail transport). These tend to be government to government,” he says.

He explains, “India has provided Mauritius with a grant and loan to fund the development of a light rail transport project, whilst China is making investments in the ports. The new Mauritian airport terminal was entirely funded by China.”

In Ethiopia meanwhile, bridging the infrastructure gap is more complicated. Mehrteab Leul, Principal of Mehrteab Leul & Associates Law Office in Ethiopia, explains, “In February this year, Ethiopia enacted a new proclamation facilitating PPPs called the Public-Private Partnership Proclamation. According to the proclamation, it is within the powers of the PPP Board to approve PPP projects as well as instruct public bodies/enterprises to carry out a certain project as a PPP.

“According to the policy document, one of the main objectives for PPP projects is to increase the financial resources available for the development of infrastructure services in Ethiopia. All of the 17 recently approved under the PSE centre around the delivery of infrastructure services,” he notes.

Leul says that China and Italy are the prime role players infrastructure investment in Ethiopia. They have made a significant impact on the sector including via developing electricity generation capacity, supplying drinking water in urban and rural areas, developing road infrastructure and building hospitals and other infrastructure investments.

“Since 1957 the Italian contractor Salini Impregilo has completed 20 major projects in Ethiopia, worth a total of €9 billion. Chinese infrastructure investment in Ethiopia totalled $4.7 billion between 2009 and 2012.”

Leul says that in terms of the BRI, a strong win- in situation has developed for both China and Ethiopia.

“In particular, the country has benefited from infrastructure development funding, as well as technological transformation from China to Ethiopia and job creation. In general, it will enable both countries to optimize the benefits from the global market. The Addis Ababa-Djibouti Railway project is a working example of benefits of the BRI,” he says.

Leul cautioned however, that the BRI, “might leave the country open to the risk of troubled debt pressure and increasing dependence on China.”

Omar Besbes of United Advisers in Tunisia notes that all North African countries have signed the Belt and Road Initiative with China. However, the benefits received from this initiative are divergent. While in Tunisia it is only focused on studies of infrastructure projects so far, in Algeria and Morocco some infrastructure projects are already implemented such as seaports and desalination plants.

For North African in countries, the benefits of the BRI are that it allows recipient countries to not have to depend on traditional donors, and gives them the opportunity to benefit from China’s growth. Besbes says that countries other than China that have played a substantial role in infrastructure investment in North Africa include the European Union, Japan France and Germany. As a result on their funding, roads, bridges, ports, airports, electricity production stations and desalination plants have been built in the region