Weekly overview and short-term outlook to Wednesday 06 March 2019

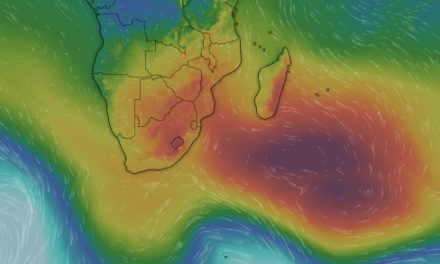

Visual: Computer generated wind pressure map of Friday 01 March

Source: https://www.windy.com/-Pressure-pressure?pressure,-21.289,69.346,3

Recent Developments

This week was in many aspects similar to last week except for the “thick” atmosphere, still under some high pressure control in the alto levels which brought back the swelteringly hot afternoons.

The pattern was interrupted briefly during Tuesday night with a cooler intrusion from the south following the passage of a weak frontal system across the southern Cape. While Wednesday morning was noticeably cooler as far north as Otjiwarongo, the heat resumed that same afternoon as the energetic effect of diabatic compression kicked in.

Note to reader: Diabatic compression derives from the Greek diabaino, loosely translated as to pass through or the move from one position to another. Pilots are familiar with the concept adiabatic lapse rate, which is always a constant for a given temperature and elevation. It refers to the reduction in air pressure as the elevation increases. Diabatic compression refers to the increase in pressure as an air column slowly sinks. It is what brings us Oosweer.

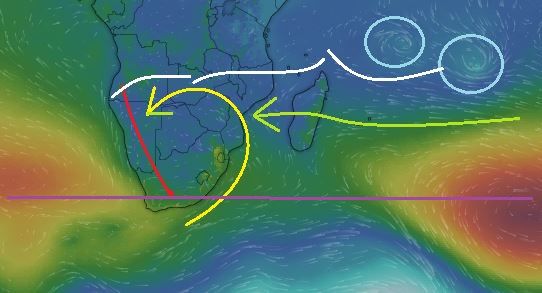

This week’s visual, based on satellite telemetry during Friday morning, provides a snapshot of the general weather pattern for southern Africa and the southern Indian Ocean. The two light blue circles are two developing depressions that will first move towards Madagascar before veering to the south-east in about four days. These low pressure systems are widely accredited for draining moisture from East Africa but that is only on their northern side. On their southern side, as they rotate, they also carry huge amounts of moisture aloft which is picked up by the northern rim of the southern Indian high pressure cell thus transporting a considerable part of that moisture at higher elevations back to the continent. The green line shows the high low interface and the route the moisture travels back to Africa.

Where this transport encounters the south to north airflow of the South Atlantic high pressure cell, it deflects the air movement onto the continent, driving the anti-cyclonic circulation over the sub-continent which is a hallmark of summer weather. This anti-cyclonic circulation is indicated by the yellow curve. It is also the conveyor of warm, moist air from Zambia and Angola into Namibian airspace and it is manifested by a constant north-east to northerly airflow over Namibia.

Where this intruding air meets the outer rim of that part of the South Atlantic high that is still west of the continent, a so-called convergence zone forms, indicated by the red line. The position of this zone shift either to the east or the west depending on the relative strengths of the high versus the anti-cyclonic circulation. If this line moves to Botswana, Namibia is dry. If it approaches the escarpment, chances for rain over the interior improves. This week the convergence zone was well-demarcated with ample cloud formation east of the line.

The white lines indicate the approximate position of the Inter-Tropical Convergence Zone, a very broad band of which only its southern perimeter affects Namibia.

Over the past month, the Inter-Tropical Convergence Zone has shifted deep into Angola, and over the past two weeks, back to the Namibian Angolan border, or very close to it. At this stage, it is the only positive new development.

If the South Atlantic high moves southwards by only 600 to 800 km, it provides space for the anti-cyclonic circulation (yellow curve) to advect moisture from the Inter-Tropical Convergence Zone into Namibian airspace, usually following the local convergence zone (red line) from north to south.

That this is quite possible has been demonstrated two weeks ago, when the core of the South Atlantic high shifted to the south by about 1000 km in about 10 days before it moved back to its “normal” position last week.

The straight purple line is more or less the latitude where the high pressure cores dwell most of the time, immediately showing that the South Atlantic high is still slightly displaced to the north while the southern Indian high is slightly on the south side.

On the Radar

High pressure control remains in force over about two thirds of Namibia during the weekend but it begins to recede late on Sunday.

The South Atlantic high sits west of Lüderitz but its core is far offshore, about 2000 km away. The outer rim at 1016 mB also stays offshore but close to the mainland.

Similar to the pattern of the past two weeks, ample cloud formation is expected at the mid and upper levels (15,000 to 25,000 feet) with even some cloudiness at around 35,000 feet but this is limited to Namibia’s northern half east of the convergence zone.

The weekend’s rainfall prospects are therefore bleak except for Owambo and the northern areas of Kunene.

The same overall picture carries on next week, with wandering high pressure control, suppressed convection, and consequently lessening rainfall probability.

With the South Atlantic high’s core so far offshore, the convergence zone is expected to migrate to the west until it hugs the escarpment. The result is progressively improving rainfall conditions from Monday to Wednesday, pushing west and south. By next Wednesday, the outlook is reasonably positive for rainfall across the whole country, from north to south, above the escarpment.