Shot down by many as a pipe dream, Kaza holds the ultimate key to rural development and regional integration

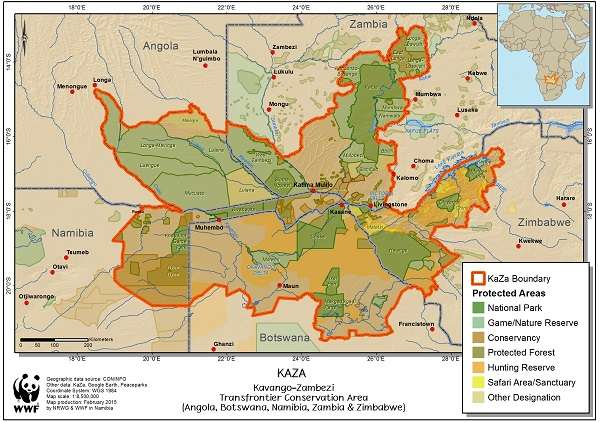

The 2015 map for the proposed Kavango Zambezi Transfrontier Conservation Area, or Kaza for short, provides a provocative take on rural development in Africa. Although there is an official inter-governmental structure dealing with Kaza, this map has been produced by the Peace Parks Foundation, and may be slightly over-ambitious in some areas, or not cognisant of on-the-ground realities in others.

Still, the concept is enticing and carries sufficiently broad political support in all five contributing countries that it has lead to the formation of a formal mechanism to advance the Kaza ideal.

Perhaps the most important departing point in any transfrontier conservation discussion is the pivotal role of local communities. If there is no buy-in at grassroots level, then the concept is dead in the water. If local communities can be convinced of tangible, beneficial results, I suspect it will be widely supported provided the bigger model is based and built on local realities.

The map shows a Kaza based on assumptions that eventually about half a million square kilometres of African land will qualify for inclusion. Exactly how that model will look nobody knows at this stage, but if the goodwill on the ground can be accompanied by international investment, then surely it is not entirely a pipe dream.

Any non-African looking at this map and wondering about the concept’s feasibility must first understand that there are local communities in each of the five countries in every region proposed for inclusion. Furthermore, it must be clear that there are competing investments and developmental projects, that may not benefit from being included in one huge game park the size of France.

It is also misleading to think the area is completely devoid of infrastructure and other developments. For instance, Katima Mulilo in Namibia, Shesheke and Livingstone in Zambia, Vic Falls in Zimbabwe, Kasane and Mohembo in Botswana, and Calai in Angola are sizeable towns with resident populations often running into tens of thousands. The proposed Kaza territory is so big it can easily carry several dozen larger towns and hundreds of villages and settlements. From an operational perspective, it is not farfetched to think of a thousand lodges and other smaller commercial entities, each a job creator in its own right.

Infrastructure-wise, it must also be remembered that the Trans Caprivi highway runs smack through the middle of this area, as does the Inter-Caprivi connector between Namibian and Zambia. But on the whole, apart from the few formal settlements, large-scale infrastructure is glaringly absent.

The map reveals other enticing possibilities. Katima is close to the centre of this conglomerate with an international (military) standard airport only 15 kilometres away at Mpacha. Immediately it must be obvious that Katima offers itself as a natural nexus to anchor all the other administrative functions. Although there are many other airports, notably at Rundu, Livingstone and Vic Falls, Mapacha is already at a level where it can receive international airliners.

But what conceivable business can international airliners have with an airport surrounded on all sides by African bush? This is where the key element of Kaza comes in. Since it will be based on a conservation model, it implies that it will depend on a clientele who is prepared to pay to share in the conservation dream.

This is an important concept. In Namibia it has been demonstrated over many years as the underlying basis for conservation: It is simple, it must be community-based and it must generate an income for the individuals living in those communities. How effective this model is, is demonstrated by the many Namibian conservancies, and by the substantial revenue these communities generate through tourism, hunting, fishing and harvesting. Alongside, they still keep cattle and goats, and produce limited amounts of crops. However, these activities on a local scale, do not interfere with the benefits the conservancies derive from their community-protected status, on a larger scale.

This is based mostly on tourism, but sustainable exploitation of renewable resources also forms part of the mix. If the people living in Kaza do not see a future in terms of financial gains, the whole Kaza concept will sink and every country, and by implication, every community will go its own way.

Kaza can only be described as a grandiose scheme in the superlative. It will probably take many years, at least longer than 20, to get to a level where it will function as a coordinated whole, but the embryonic bits are already in place.

It will take an enormous amount of investment over a very long time, but if tangible benefits can be realised along the way as the concept gains momentum, more buy-in will follow. It is such a large project, it will also have an impact on other countries in the Southern African Development Community, not only on the five direct participants.

The work that we do on Kaza can serve as guideline for much of the other regional integration goals that now only exist on paper. It is even conceivable that visitors will be able to visit any of the Kaza sovereigns on a single visa, or a SADC visa.

From a conservation perspective, this area already solves many of the unique local problems like over-population of wildlife in some areas, with large-scale decimation in others. It seeks to re-establish and re-open the old migratory routes of many species, and it interlinks several wetland biomes which have become fragmented and isolated in modern history.

And the concept is so wide and so flexible that there is nothing preventing a mine, or any other large industrial complex, to exist side by side with a well-managed, protected, almost pristine natural environment.