Political stability will spur foreign investment – Business Monitor International analysis

Business Monitor International (BMI) Research, a unit of the Fitch Group, is of the opinion that President Hage Geingob’s sizable victory at Swapo’s November elective congress, has consolidated his leadersip. BMI released it forward view of the economy and the government’s role earlier this week.

According to the firm’s analysis, Geingob’s victory will give him the political space necessary to moderate populist social and economic reforms, tempering investor caution toward Namibia.

“Geingob’s victory at the party conference will increase policy continuity and boost investors’ confidence in Namibia’s business environment. Indeed, we expect gross fixed capital formation growth to increase from 2% in 2017 to 6% in 2018, supporting real GDP g owth to recover from 0.2% in 2017 to 3.5% in 2018,” BMI said.

“The government has committed to several infrastructure projects, which will be executed through public private partnerships under the Harambee Prosperity Plan. Amongst them, the construction of several biomass-fuelled power plants in Otjiwarongo, Otavi and Arandis will increase the country’s electricity generation capabilities and spur foreign direct investment in Namibia.”

Furthermore BMI said that Geingob’s comfortable victory over the left-leaning ‘team SWAPO’ faction will enable him to moderate the more radical provisions of the proposed New Equitable Economic Empowerment Framework (NEEEF) in 2018, tempering investor caution and helping to sustain Namibia’s economic growth.

Some of the more radical measures included in the framework require that businesses sell a mandatory 25% share to previously disadvantaged Namibians.

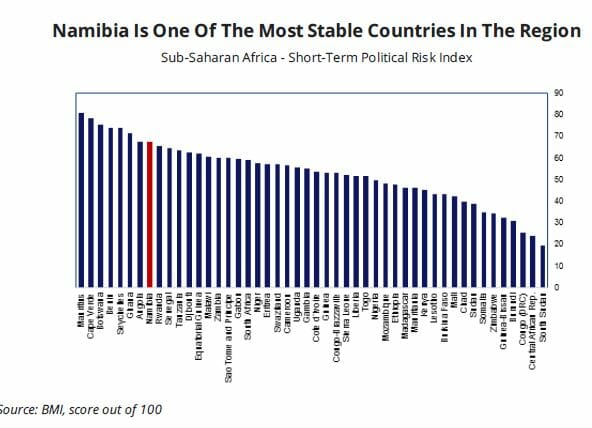

“These factors have led us to upgrade our Short-Term Political Risk Index (STPRI) for Namibia from 65.4 to 67.5, positioning the country amongst the top ten countries in Sub-Saharan Africa. More specifically, we raised the policy continuity component from 75 to 80, and the policy-making process component from 63.3 to 66.7,” BMI stated.

Meanwhile, BMI noted that the draft NEEEF bill, which was presented to Parliament in April 2016, targets the high levels of inequality, “indeed, according to the Food and Agriculture Organization of the United Nations, 10% of the population still controls 90% of the economy.”

“The draft bill was backed by the more radical factions of SWAPO, including Prime Minister Saara Kuugongelwa-Amadhila and influential former president and founder of Namibia, Sam Nujoma,” BMI added.

Similarly, the more radical elements of a proposed land reform are also unlikely to move ahead. The government had committed in 1991 to a land reform aiming to buy 4 3% of the country’s land and redistribute it to so-called previously disadvantaged persons by 2020, the research firm added.

“In recent quarters, Geingob had faced increasing pressure from the more radical members of the SWAPO party to speed up the process of land redistribution through expropriation rather than through the traditional willing buyer/willing seller model. Many have said that the model has failed to adequately address the problem and at present, 247 agricultural farms totalling 1.2 million hectares are still owned by descendants of German and Afrikaner settlers. However, as the president consolidates his power, we do not see these reforms taking a radical turn, with the risk of expropriation remaining very limited,” BMI said.

Currently BMI is of the view that Namibia is one of the most stable countries in the region.