The budget debate season has begun – sit back and enjoy the entertainment

Now that the debate over the budget has started in the National Assembly, one can expect the emphasis to fall on expenditure.

This has been the pattern for many years. Going by this week’s very first contributions, the tune is set to continue playing “What can we get out of it” with only a single contributor focusing on the bigger picture.

Fortunately, there is always at least one big gun among the weekly fray to save the debate.

It is all good and well that the vast majority of respondents always clamour for more, that a not-insignificant number wants to solve all the economic ills with their own budget, and that the average budget contribution is not worth the paper it is written on. These representatives come from a back ground of ingrained entitlement, and no matter how the budget is allocated, their share will never be enough.

I suppose if you call yourself MP, you have to sit through this voluminous drivel to get an opportunity to listen to the odd contribution based on knowledge, wisdom and common sense.

I hope that as the budget debate evolves, more people will come to realise that our immediate problem is a funding constraint and that there is nothing wrong with the Namibian balance sheet.

But I also sincerely hope that, through the few, better informed contributions, the majority of parliamentarians, or at leas a significantly bigger number than is currently the case, will understand that if you do not fix the cashflow problems, eventually they will turn into balance sheet problems.

If I say the immediate problem is about funding, then the logical question that follows is, How do we fix it? That may be oversimplified but it is crucial to realise that for us to resume meaningful economic growth, we have to have better access to funding mechanisms.

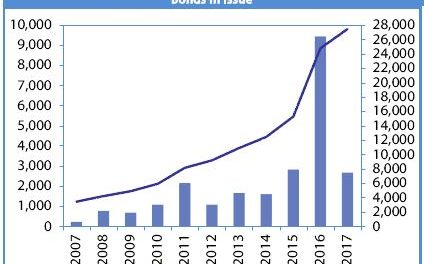

I have discussed our options in earlier commentaries. Suffice to say now is that we are not nearly at the end of our funding potential, which then implies that we can generate much more capital, if we grow the number and type of funding instruments.

My first proposal is that we aggressively launch more instruments in the South African capital market. Although we are only a fraction of the South African market, the government’s presence in the Windhoek capital market has become so overbearing, it dominates all other hopefulls into submission. Here I am not referring to parastatals but to pure private sector companies that are eager to tap into the Windhoek market but who are apprehensive since its direction and yields are overwhelmingly determined by government paper.

In the South African capital market, we are small fry. It really does not create a blip on their radar if our instruments are priced 50 or 150 basis points higher than their benchmark counterparts. The only aspect we need to watch out for is that our size does not penalise us leading to punitive premia.

In Johannesburg, we can list another eight bonds with comfortable maturities at rates that are determined by local conditions. Except for its size, the Namibian economy is not inferior to the South African, in fact I often think we have better short-term prospects and a much rosier long-term future. The biggest advantage though is that Namibian bonds on the JSE are same-currency bonds, making it easier to mitigate exchange rate fluctuations.

Locally, the obvious avenue to pursue is the proposed Public Private Partnership regime, but this will take a while to get off the ground.

For the time being, we have to contend with the Windhoek market, but even here, so-called private placements, especially with European sovereigns, will go a long way to improve local liquidity.

Remember, the government, at least for the foreseeable future, is the generator of an estimated 65% of all liquidity, directly and indirectly through its procurement and through its massive wage bill. To change that will take several years, so the most obvious solution to repair the impeded liquidity, is to get government spending rolling again.

If this sounds reckless, just look at the economic growth of the 2010 to 2015 period. That was solely built on government spending and it is a fruitless exercise now, to try and stop that too abruptly. Granted, over the medium term, government debt has to be managed, but only to keep it in check as a percentage of the output of the country as a whole. The nominal amount of outstanding government debt is academic, what is real and of great concern is how that debt functions in the broader economy to make the cake larger for everybody.