Zigzag car sales

Motor vehicle dealers are likely to feel much pressure this year as the government, which is the biggest spender stared to curb spending on unproductive assets, as part of its fiscal policy consolidation, Simonis Storms Securities stated in a report released earlier this week.

The decline in overall new vehicle sales was a reflection of a substantial slowdown in sales registered across all categories, while the government’s decision to cancel vehicle tenders, is a trend that is likely to continue in the medium term. This was noted after the National Association of Automobile Manufacturers of South Africa released Namibia’s vehicle sales statistics for January last week.

”The luxury vehicle market is most likely to feel the pinch if the price for vehicles increases further,” said Frans Uusiku, Economist at Simonis Storms, adding that this increase is mainly likely to be exacerbated by external pressures such as the weakening of the rand. “Most of the vehicles are imported from across the globe and the little that are manufactured and/or assembled in South Africa are also currency inflated” he said.

Monthly total vehicle sales contracted by 19.1% to 1389 units compared to 1716 in January 2015 Uusiku further notes in this regard that there has been a substantial decrease in the purchases of commercial vehicles (medium, heavy, extra heavy and buses) which is one of the important components of capital formation.

The value of vehicle sales declined by 18.4% to N$4.9 billion in January from N$5.8 billion in December 2015. Of interest in this regard is that instalment credit during December had also registered a significant slowdown. This is also inferred in the new vehicle sales figures.

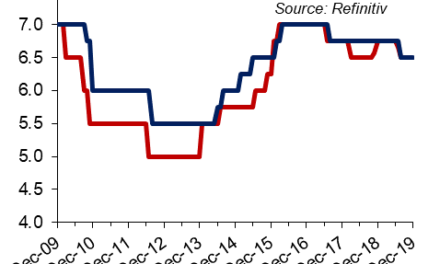

“Motor vehicle dealers in Namibia expect a price increase in vehicles of about 5% to 6% as from March 2016, and this could exert further pressure on the future purchases of vehicles. Increases in the price of vehicles (as triggered by Rand depreciation and inflationary pressures) and the expected increase in interest rates is likely to curb real consumer spending and ultimately vehicle sales, going forward,” he said.

With oil prices reaching significantly low levels of between US$25-30 per barrel since the beginning of 2016, Simonis Storms sees this as another bearish sign and expects it to be reflected in vehicle sales for the rest of 2016.

“This is because, the weakening of the Rand, coupled with high interest rate expectations and government plans to reduce spending on unproductive assets (e.g. passenger vehicles) holds the potential to significantly bring down the monthly vehicles sales figures for the rest of 2016,” Uusiku concluded.