Tilman Friedrich’s Benchmarks June / July 2014

Tilman Friedrich

In the light of this background, as far as local equity sectors are concerned we prefer the financials -, industrials – and basic materials sectors to consumer goods and consumer services although value can be found in all sectors. Download the complete Benchtest fund investment overview for May 2014 and the Early Bird for June 2014 at http://www.rfsol.com.na/benchmark

Property remained the top performing asset class followed by equity, bonds and cash. Over the 12 months to end May, compared to the 12 months to end of April, local equity was the top performing asset class but property moved from the worst performing asset class at the end of April to the 2nd best performing asset class at the end of May. The Rand depreciated over both 12 month periods, much more pronounced though over the 12 months to end of April (-17.2%) compared to the 12 months to end of May (-4.4%). Considering the main economic sectors in equities the most pronounced change over the 3 and 12 month periods to end April and end May was an improvement in the fortunes of Basic Materials from -3% to 7% over the two 3 month periods and from 13.2% to 31.7% over the two 12 month periods.

The punishment investment managers with a high offshore exposure endured at the hands of an appreciating Rand should thus be less pronounced when comparing 3 month performances at the end of May to those at the end of April. Asset managers typically holding a fairly low exposure to property and the turnaround in the fortunes of property over these two 3 month periods should be less noticeable. Equity both locally and offshore, remained the top performing asset class for both 12 months periods to end April and end May, which should have benefited the more aggressive investment managers with a high equity exposure. Over the two 12 month periods the more pronounced depreciation of the Rand to end of April should have benefited investment managers with a high offshore exposure more to end of April than to end of May. The fortunes of investment managers with a high exposure to Basic Materials should have improved quite a bit over both the 3 and 12 month periods At this stage local and offshore equity may be expected to remain the best performing asset class for the next 12 months as the result of monetary stimulus measures being maintained globally, despite the fact that markets are already expensive. There is a chance of interest rates being raised in the US later this year although the US government will not really be able to shoulder anything but a minute increase in interest rates due to its high indebtedness, unless this was accompanied by increasing inflation.

Local interest rates may well be increased again soon by the SA Reserve Bank particularly in view of the down grading of SA’s credit rating by Standard & Poors to BBB-, one level above junk, while Fitch lowered the outlook on its BBB grading from stable to negative. This will impact negatively on returns on interest bearing investments and on property but will lend support to the Rand. It is therefore likely that the Rand will maintain its current position and may be expected to move sideways for the next 12 months.

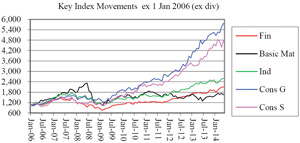

With a stable Rand and equities continuing to be driven through monetary stimulus, equity is really the only conventional asset class that should outperform the other asset classes. Interest bearing investments present the risk of capital losses in the event of an increase in interest rates. Given that equities do present a substantial risk, being overvalued in many cases, the investor needs to be selective as to what equities to invest in that will not be affected as much by a correction in valuations that is likely to occur. The ‘value’ style of investing, where valuation and dividend yield plays an important role in selecting specific shares is our preferred investment style in the current environment although one may sacrifice returns in the face of a tidal wave carrying equity to ever higher levels. Diversifying to offshore markets also remains a sensible strategy in our assessment. As the below graph depicts, some indices had an unbelievable run since the beginning of 2006, producing annualised returns 23.2% (Consumer Goods), 20.5% (Consumer Services), 12% (Industrials), 9.2% (Financials) and 6.1% (Basic Materials). These returns must be seen against the backdrop of inflation of 6.7%.