Bannerman Resources receives close to N$10 million for Etango

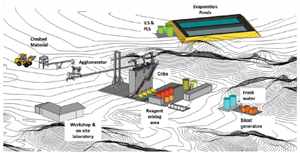

A graphical representation of the envisaged plant

The pilot plant is considered a cost-effective way of mitigating risk from the Etango project by confirming the definitive feasibility study assumptions, Bannerman announced in a recent update. The project will demonstrate the viability of the heap-leaching concept to potential partners and financiers, and it is said to be progressing towards a detailed engineering stage.

Key outcomes from the definitive feasibility study announced to the market on 10 April 2012 showed that the mine would have a minimum life of 16 years, with further extensions possible through the inclusion of measured and indicated resources below the designed pit, and conversion of existing inferred resources. Pre-production costs were expected to run in excess of US$850 million. Furthermore, at prevailing uranium prices of the time, the mine would possibly generate revenues in excess of US$920 million after capital and mining taxes have been deducted, Bannerman said in the statement.

The pilot project will be located at the Etango Project site, and the capital cost is estimated at approximately N$10 million. It is expected that the plant will be commissioned during the fourth quarter of this year, thereafter operating at a cost of approximately N$400,000 for a period of at least twelve months, Bannerman announced.

The internal review of the geological and resource models will be completed in the second quarter of this year. Work to date has highlighted the potential to increase the ore feed grade to the processing plant. This is expected to continue up until the third quarter of this year and a decision on updating the mineral resource and ore reserve models will be deferred to post completion of the work, Bannerman said in the statement.

The Etango Project is one of the world’s largest undeveloped uranium deposits, located in the Erongo uranium-mining region of Namibia which hosts the Rössing and Langer Heinrich mines and the Husab Project, which is currently under construction by the Chinese state-owned enterprise, China General Nuclear Power Company (CGNPC). Etango is situated 73km by road from Walvis Bay. Bannerman Resources Ltd is an exploration and development company with uranium interests. Bannerman’s principal asset is its 80% owned Etango Project situated south-west of Rio Tinto’s Rössing uranium mine and CGNPC’s Husab Project currently under construction, to the west of Paladin Energy’s Langer Heinrich Mine.