Private sector credit extension picks up moderately in December, thanks to higher lending to households

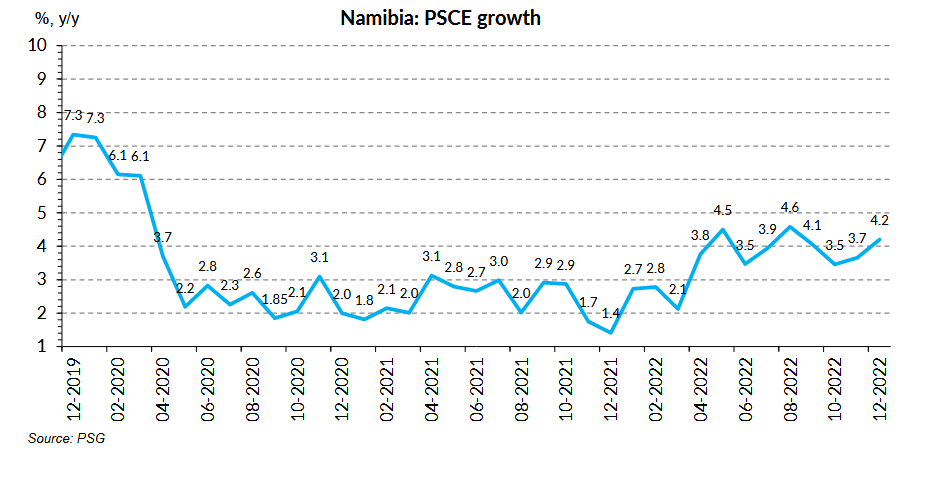

Private sector credit extension growth rose to 4.2% y/y in December, up from 3.7% y/y in November, according to the Bank of Namibia’s (BoN) latest reports.

This upsurge is due mainly to higher lending to households. That is according to financial services and investment firm PSG Wealth Management Namibia, which highlighted that despite a recovery in domestic economic growth, credit demand is still muted compared with pre-pandemic levels due to rising interest rates.

Research analysts at PSG Namibia noted that growth in total credit extended to businesses increased by 3.5% y/y in December from 3.1% y/y in November. Moreover, they also revealed that growth stemmed from increased demand for short-term credit facilities by corporates in the energy and services industries.

“Credit extended to households also picked up, growing by 4.7% y/y in December relative to the 4.1% y/y logged in the previous month,” they said, adding that the increase was more evident in other loans and advances as well as in mortgage credit.

However, the analysts explained that the stock of foreign exchange reserves rose by 9.7% m/m to N$47.9bn at the end of December. Citing BoN data, the analysts pointed out that mainly thanks to African Development Bank loan inflows, diamond sale proceeds, and increased net commercial bank inflows.

“Looking at the monetary aggregates, the broad money supply (M2) remained stable (posted growth of 0.0% y/y) in December, which is, nevertheless, an improvement from a contraction of 0.6% y/y in the preceding month,” PSG said in a publication they issued on Thursday.

This is while the stagnation in M2 growth mainly reflects the contraction in ‘other deposits’ in 2022, which was offset by increases in currency outside depository corporations and transferable deposits.

Overall, the monetary and credit aggregates had a “tepid recovery” in 2022 as growth rates remain well below pre-pandemic rates. According to the central bank, although real GDP grew moderately in 2022 and is nearly back to its pre-pandemic level, rising interest rates have stymied credit demand as higher rates raise borrowing costs for households and businesses.

Meanwhile, following the South African Reserve Bank’s (SARB) recent decision to raise its repo rate by 25 bps in January, PSG expects BoN will follow suit by raising the Namibia repo rate to 7.0% from 6.75% in February.

“We expect the Namibian repo to be kept stable in 2023 as the inflation rates in Namibia and South Africa, are anticipated to remain elevated compared with the midpoint of the inflation target (4.5%). Meanwhile, we forecast real GDP growth to moderate to 2.6% in 2023 from 3.9% in 2022,” the financial services and investment firm added.

The firm also said they expect the global growth slowdown in 2023 will take some shine off the recent glittering performances of Namibia’s diamond mining and manufacturing industry and slow down the recovery in tourism. “The high-interest rate environment and moderation in economic growth in 2023 will continue to hamper the growth of monetary and credit aggregates this year,” PSG concluded.