Effective banking governance should not be taken lightly says !Gawaxab

The Bank of Namibia issued a revamped Determination on the Appointment, Duties, and Responsibilities of Directors, Principal Officers, and Executive Officers of Banking Institutions and Controlling Companies (BID-1) to enhance the corporate governance of banking institutions in a sector considered very sophisticated by African standards.

In a statement this week the central bank said going forward, the revised Determination will serve as the foundation for sound corporate governance in banking institutions and controlling corporations charged with safeguarding public deposits, protecting consumers, and providing access to credit.

Furthermore, the Determination puts rules in place for banking institutions to attract and retain top-

tier business executives and seasoned experts to provide the necessary oversight and help develop and guide the execution of business strategies of banking institutions.

The Determination thus strives to, among other things, ensure that only individuals who are “fit and proper,” as determined by the Bank of Namibia, as the regulator and supervisor of banking institutions, are assigned to positions of authority within the boards and management of banking institutions and controlling businesses.

According to the central bank, for the first time, limits have been set on the number of years a director may serve on the Board. In this regard, board members may only serve for a maximum of ten years on a board of a banking institution, with exceptions considered on a case-by-case basis. An independent director including the chairperson of the Board of Directors can only serve on the board till they are 70 years of age, in line with best practice.

Limits have also been set regarding the number of boards a board member may serve to ensure that they apply themselves entirely to their fiduciary duties and complex responsibilities associated with banking institutions.

The Determination rules that a prospective board member at a banking institution or controlling company may not serve on more than two boards at a time. Exceptions will be made for directors who are not in full-time employment or who serve on boards of a banking institution, the banking group, the controlling company or holding company, and any subsidiary belonging to the same group which will be counted as one. Other exceptions include educational institutions and other similar bodies.

The Determination also subjects Persons of Prominent Importance (PPI), previously known as Politically Exposed Persons, to more rigorous and advanced due diligence on their wealth, business ownership, and other background checks to mitigate any conflicts of interest.

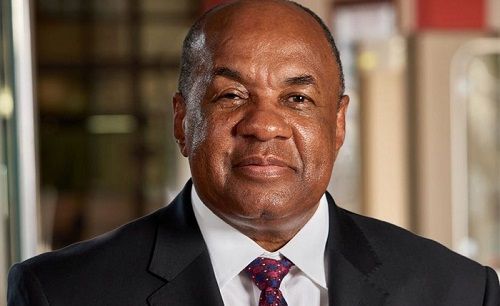

Governor Johannes !Gawaxab stated: “Effective banking institution governance should not be taken lightly because it directly impacts financial and macroeconomic stability. Excessive risk-taking, unethical behaviour, fraud, and mismanagement are just a few examples of how bad practices have led to systemic bank failures worldwide.”

The Determination, effective as of 16 December 2022, applies to all banking institutions authorised by the Bank of Namibia to conduct banking business or control companies of banking institutions in Namibia.