FNB Pay enhances payment options for clients

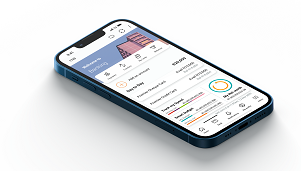

FNB recently introduced FNB Pay, the Bank’s new payments umbrella in the FNB App which customers can now receive contactless payments easily and safely on their android smart devices, without the need for a separate point-of-sale device.

FNB CEO, Jacques Celliers last week said while the Bank’s digital interfaces give customers access to a wide range of credit and investments solutions tools, payments and cashflow are the lifeblood of any economy

“The facilitation of payments for individuals and businesses is one of the key features of the power of network effects of our platform,” said Celliers.

The new or enhanced payment solutions that are available on the FNB App include:

Instant Payments – a first-to-market instant payment solution that enables customers to digitally pay anyone via the FNB App using just a card number. The recipient gets the money instantly in their bank account, irrespective of where they bank.

PayMe – allows customers to request a payment digitally to any FNB Banked cellphone number. The person requesting the money simply follows a few prompts, and the ‘payer’ is immediately notified and simply needs to accept the request to make an immediate payment.

ChatPay – allows customers to pay or request payment from any FNB customer using the FNB App’s chat functionality without the need for an account number. Customers can initiate a chat using their contact list, and because the interaction takes place within FNB’s platform, they can be confident that it is safe.

Bill Payments – a quick and convenient way for customers to use the FNB App to pay their EasyPay or Pay@ bills including municipal rates, medical and other services.

Virtual Card – Customers can now use their Global Virtual Cards for travel bookings such as buying flights or booking accommodation and adding the virtual card to third-party digital wallets such as Google Wallet or Apple Pay for convenient and safer payments when traveling abroad.

Speedee App – allows businesses to receive contactless payments easily and safely on their android smart devices, without the need for a separate point-of-sale device.