Inflation is likely to remain elevated in the short to medium term – !Gawaxab

Inflation is likely to remain elevated in the short to medium term, and as a result, the Bank of Namibia, as the monetary authority, will likely continue to tighten financial conditions in response to rising inflation to avoid embedding the current high level of headline inflation expectations and shore up firm price-setting behaviour.

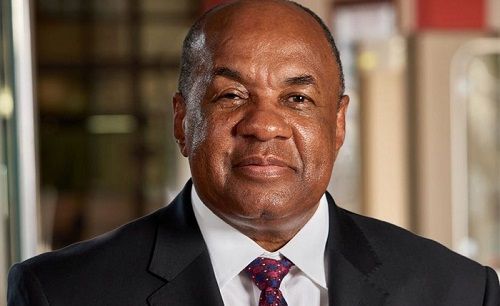

Central Bank governor, Johannes !Gawaxab, Governor of the Bank, stated this in a public lecture delivered this week at Rundu titled “Navigating Current Economic Shocks: Policy Options.”

“It is important to maintain a foundation that safeguards macroeconomic stability in the country, that is essential for economic growth and development, and for this reason, the Bank of Namibia cannot sit idle and watch inflation run away,” he said.

According to !Gawaxab, the Bank has moved quickly to ensure price stability, using the tools at its

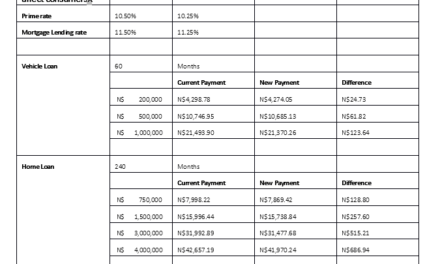

disposal as a member of the Common Monetary Area (CMA), by preventing the wage-price-setting spiral that could lead to inflation becoming entrenched, preventing capital outflows to the anchor country, and maintaining the one-to-one peg with the South African Rand. In this regard, the Bank raised the repo rate by a cumulative 100 basis points in February 2022 (25 basis points in February, 25 basis points in April, and 50 basis points in June 2022).

The Governor signaled that this trend is likely to continue to counter inflationary pressures and most importantly align the domestic interest rates to the CMA’s interest rates.

“The current inflationary pressures in the economy are imported and primarily the result of supply-side factors, particularly the constraints imposed by the Russia- Ukraine war, with concerns about commodity shortages growing as hostilities between the warring parties intensified. Fuel prices, in particular, have underpinned the rise in inflation across countries, including Namibia, and the resulting rise in the prices of basic commodities has put pressure on households and businesses whose

incomes have already been hit by a series of shocks,” he noted.

These developments, the governor, was quick to point out, were a direct result of external factors beyond the control of any authority. To cushion the economies against inflation, central banks around the world have reduced the monetary stimulus that was in place since the Covid-19 pandemic, increased interest rates or are using other monetary policy tools.

The public lecture aimed to provide a basic understanding of current economic shocks, their origins, and how Namibia, as a small open economy, can insulate itself from mounting externally driven shocks and pressures. To that end, the Governor emphasized policy actions for inclusive economic growth to assist the country in navigating these turbulent times.

“As the country reels from yet another external shock, we should aim to identify solutions that drive economic recovery and development by building a resilient economy and capitalising on digitisation,” he said.

Dispelling recent claims that Namibia is among the riskiest nations to lend to, the governor was adamant that despite the nation’s vulnerabilities because of the higher level of public debt as a percentage of GDP which stands at 69%, Namibia is still able to meet its obligations. It is important to note that countries that have defaulted in the past are those with higher levels of external debt as a share of total public debt.