In a game of chicken, it’s important not to flinch first

A Rand that went north beyond R11 to the US dollar last week, gave the South African Reserve Bank no end of a scare. Earlier this week, the central bank in Turkey, announced a drastic increase in interest rates, almost doubling the base rate, which only helped to increase the flutter in the stomach of our southern neighbour’s monetary policy authorities. The result was the unexpected 50 basis point repo rate increase announced on Tuesday by the South African Reserve Bank. Their repo rate now stands at 5.5%, the same as in Namibia.

Interestingly, while the South African and Namibian repo rates are now on par, the SA prime lending rate is still only 9%, indicating to me that local financial institutions still have some way to go with financial sector reform. Of course, the commercial banks will not agree with me, citing all sorts of constraints in terms of market size and competitiveness, but I suspect the Bank of Namibia will not let it go so easily.

When the repo rate in SA is exactly the same as our repo rate, it creates a conundrum for the Bank of Namibia since conventional financial wisdom wants us to believe that a small differential is required to maintain adequate liquidity in the local market.

But I am beginning to question this wisdom, and the most obvious measure I base my doubt on, is the glaring difference in GDP growth between us and South Africa. It seems to me they will be lucky to book 2.5% real GDP growth for the financial year that ends in a month whereas Namibia may reasonably expect to come close to 5% growth.

Following the SA rate increase, the currency stuttered some more, and by Thursday was trading around R11-35 to the US dollar. Euro and British Pound exchange rates were even more horrific.

It is not difficult to find the reason for the steady deterioration in the exchange rate, one only needs to look at the daily portfolio flows in and out of South Africa. Foreign investors used to be net buyers of SA bonds and stocks, but this trend became marginal in November and reversed during December. The Rand depreciation then gathered momentum as foreign investor rapidly turned into net sellers. Earlier this month, the Rand breached the R11 level for the first time.

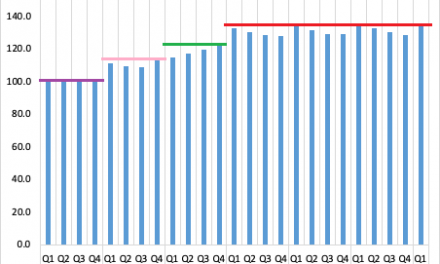

I would not call the Rand’s performance a slide comparable to currency movements in India, Korea and Turkey, but it certainly is a cause for concern. However, I believe the Rand’s weakening has very little to do with domestic economic conditions and much more with investor trends in Europe and the US. I find support for my view in comparing current short-term interest rates in Europe, the UK and the US, to the respective rates about three months ago. The rate on the US 10-year treasury bill has started a noticeable increase during the third quarter of 2013. A similar trend was observed in Germany and in the UK. US treasury bills touched the 2.9% mark in November while the interest rate on German sovereign debt came close to 1.9%. Meanwhile stock markets were ablaze and the Dow Jones set a new historical record going about 16000 index points. Towards the end of December, interest rates on sovereign debt in my three sample countries started receding. Earlier this week US debt fetched 2.6% inching up to 2.7% closer to week’s end, but German rates stubbornly remained around 1.6%.

Stock markets pulled back in tandem and the Dow refused to regain lost ground, remaining below 16000 even after a good performance on Thursday.

What does this tell me?

First, it points to investors pulling out of the stock markets and going for sovereign debt as a safe haven. This pattern is very typical, and has been observed umpteen times since 2008. Second, it shows that money must be leaving emerging market, (as witnessed by the SA portfolio flows), and returning to mainstream US and Europe markets. Note, that the past two weeks’ movements are not a slide, rather a trend, but it is seemingly gaining momentum.

The underlying reason for the exchange rate volatility and the tell-tale interest rate movements on sovereign debt, according to my view, is the uncertainty surrounding the US Federal Reserve’s bond buying programme. What everybody calls tapering, is also now on everybody’s lips and the observable outcome is a so-called flight to safety, again a phenomenon we have seen many times in five years. I believe the Reserve Bank has flinched too soon. The weakening of the Rand is not as dramatic as some twelve years ago when it crossed the R13 level, and the improved spread between local short term rates and sovereign rates in the US, should lead to improvement in portfolio flows. Central Banks in Africa must be aware of this see-saw mechanism and not impede growth through irrational interest rate adjustments. Of course, as an arch-contrarian, I also believe the improved spread actually creates room to bring interest rates down further, not up.