Capital allocations in Namibia’s financial sector

By Arney Tjaronda

Financial analyst at High Economic Intelligence.

The financial sector of Namibia plays a vital role as they pool private capital to invest in domestic development. Efforts made by the government to avail borrowing options like treasury bills, bonds, and other securities to unlisted investment companies in the private sector aid to reduce currency mismatches, systemic risks, microeconomic and fiscal risks.

They also provide sustainable financing in sectors associated with employment and economic growth. Our so-called “experts” claim that capital markets are illiquid because of poor quality unlisted investments, while, that is an overstatement that needs evidence. Or maybe they are those “experts” that use assumption-based knowledge only, but let me just leave it there.

Capital allocation in the financial sector can be understood as the decision-making process to answer questions like where and how CEOs spend the returned earnings available from the company’s balance sheet at year-ending financial statements. In most cases, this spending should be utilized to maximize efficiency and shareholder’s return in the value-creation process.

Before investors make that decision, they look at what is known as the Capital Allocation Line, which is a graph created by investors to measure the risk of those assets. There are three types of financial capital for base touching and they are; equity, debt, and speciality. The circulation of allocated capital from one investment vehicle contributes to economic growth and market efficiency. One popular belief by industry experts is that an “efficient secondary market helps investors distinguish good investments from bad ones through a mechanism like Tobin’s Q” as stated by Jeffrey Wurgler (1999). Good and bad investments are collectively analysed by domestic activities in each respective sector.

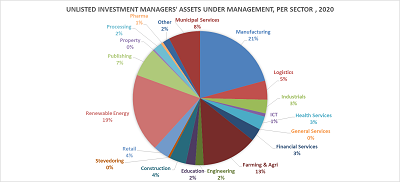

In Accounting, they say that you are at least a year behind, therefore according to NAMFISA’s Annual Report (2021), which analysed unlisted investment managers’ assets under management, per sector, at 31 December 2020, is vital when looking at it from an investment perspective.

The chart seen gives you as an investor a good view as to which sector takes the largest piece of the ‘pie’, which ultimately also means that there is high frequent engagement in economic activity. There are three main sectors in which CEOs allocate their capital. From a chronological order, which is; Manufacturing, Renewable Energy, and Farming & Agriculture. Major players such as Hanagala Group, Eos Capital, Eljota Investment Managers, and Baobab Growth Fund inhabit that space therefore, it is always logical to ‘follow the herd’ because of the displayed presence of an active market to gain a piece of the market share for yourself.

Namibia’s biggest financier for many unlisted investment companies is the Government Institution Pension Fund (GIPF) following the provisions of Regulation 13 of the Pension Funds Act in Namibia. Billions of Namibian dollars are pumped into those companies every year, whereas they manage the capital and allocate them to sectors where growth is imminent from the rest

However, looking at the market on the ground, there is no growth in the capital financing in the MSMEs of Namibia, despite the efforts made by the GIPF. Maybe the “expert” criticized in the beginning is right, perhaps the issue is not with the allocation of capital in the financial sector, but with the quality of unlisted investments.

Lastly, as the famous colloquial goes: “It ain’t over till (or until) the fat lady sings. So let us wait and observe the financial sector. Perhaps, the growth will still prevail in due time.