Tilman Friedrich’s Benchmarks Nov/Dec 2013

Download the complete Benchtest fund investment overview for October 2013 and the Early Bird report for November 2013 at http://www.rfsol.com.na/benchmark Tilman Friedrich is a qualified chartered accountant and a Namibian Certified Financial Planner ® specialising in the pensions field. Tilman is co-founder, shareholder and managing director of RFS, retired chairperson, now trustee, of the Benchmark Retirement Fund.

Tilman Friedrich is a qualified chartered accountant and a Namibian Certified Financial Planner ® specialising in the pensions field. Tilman is co-founder, shareholder and managing director of RFS, retired chairperson, now trustee, of the Benchmark Retirement Fund.

We have previously been reporting and have placed a lot of emphasis on the impact that global quantitative easing, or asset purchase programmes undertaken by reserve banks, had on emerging economies and more specifically on commodity based economies.

These measures have and are still producing a strong flow of capital into emerging economies.

This flow presents an artificial support of the currencies of emerging countries, artificial support of their equity markets and an artificially low interest rate environment. This artificial support will fall away as soon as these programmes are reduced and eventually withdrawn.

At this stage it seems that the Fed will put the brakes on its asset purchase programme in the next year but that it will continue with its zero interest rate policy.

If this will be the case, one may expect the further bloating of global equity markets to recede although a low interest rate environment will still result in an investor equity bias.

The investor needs to now look beyond the tapering by the Fed. For South Africa and Namibia, being commodity-based economies, our economies and markets are highly sensitive to movements in global commodity markets.

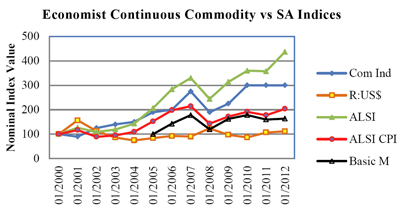

Against this backdrop, it is interesting to study global commodity markets and how this impacted on our currencies and markets.

This can also provide a cue to how our local equity markets are likely to develop over the next few years. The graph below lucidly presents some interesting correlations with the ‘Economist Continuous Commodity Index’ (Com Ind).