We need to keep an eye on US inflation. The ramifications for Africa are enormous

Inflation in the USA is scaring the pants off investors after this week’s data shows the highest rise in 31 years in October. For the Americans who have become used to annual inflation below 2%, it is scary, suddenly to have to deal with inflation above 6%.

The inflation debate did not crawl out of the woodwork in an instant in October. It has been going on for the better part of this year, at least since the second quarter when analysts started noticing the rising trend. At that point around May this year, inflation was printing consistently above 2% but the US Federal Reserve was of the opinion that it is temporary following the lifting of travel restriction, and will revert to mean within a few months. However, the assumption then was that a rise above 4% is unlikely.

So you can imagine how it shocked analysts when the real figure for October, published this week on Wednesday 10 November, printed 6.2%. Suddenly it no longer looks like a temporary, transitionary phase that will correct itself as the base settles. It certainly starts looking like a longer term trend, and it seems fairly aggressive.

This had ramifications for the US Dollar which appreciated strongly overnight, leading to a weakening of the South African Rand, and by connection the Namibia Dollar, of just over 1.5% in just 12 hours.

During the inflation debate of the past six months, all sorts of explanations were offered. The most popular one is pent-up demand. Apparently, while Covid raged for a year and half, Americans had little to do and saved whatever they could. Now they want to spend this money with the result that demand has jumped and so have prices.

The second, leading from the first, is that supply chains are globally disrupted, again due to lockdowns, and that the increase in demand has basically knocked over some segments in international logistics. The long and the short is that there are not enough ships afloat to carry the massive volumes of cargo that must now move prompto prompto from the Far East to Europe and America.

But there is a much simpler explanation and I believe this is at the core of the surge in inflation, and that is will remain with us for a relatively long time.

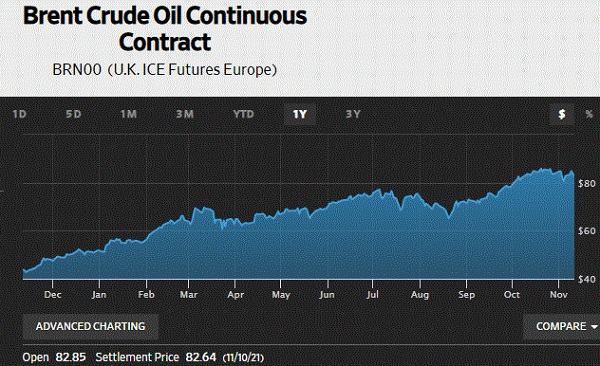

If I consider the Brent crude price’s move over the past year, I notice that it went from just above US$40 per barrel to comfortably above US$80 this week. It does not need complicated calculations to show anyone that the cost of moving stuff, or at least a very large part of it, has doubled over the past year.

Where energy for manufacturing is derived from oil derivatives, the same principle applies on the factory floor.

Now, it is impossible to have your transport costs double and not see that reflected in the retail price of goods. The Americans should be thankful that the October jump is only 6.2%. Were it not for their very large crude inventories, this impact would have been felt earlier. As it were, it has only now started working through the energy value chain.

Again, if the price of oil almost doubled in a year, the price of goods still have to rise a fair bit. It is not always possible to calculate these moves accurately in advance because oil does not play the same role in all manufacturing but you can’t get around the basic fact that eventually, the higher oil prices will filter through to everything.

Similar to what happened in the run-up to the 2008/9 Great Recession, oil’s pervasive presence in the rest of the economy has the potential to disrupt markets enormously. When West Texas Intermediate hit US$146 per barrel, it was only a matter of time before inflation dragged the entire world economy to a standstill.

We must not think it cannot happen again, and we must have a balanced view of what higher oil prices mean for us in Africa.

For countries like Nigeria, Angola and Sudan, it is a blessing, but the rest of the world can afford only so much for oil. When crude is too low (US$40/barrel), it hurts us because it slows down the Angolan economy which is a huge source of consumption for the Namibian economy.

But when they rise too high (US$80/barrel), they start pushing up local inflation especially in Namibia where we cart more than 80% of everything we consume. We need to keep a keen eye on American inflation. If it continues to rise, as I think it will, then we are in for all sorts of sports.

Not only will consumer prices rise sharply but our interest rates will have to go up as well to compensate for the reduced spreads. Every notch inflation goes up makes it more difficult for businesses to operate and almost impossible for poor people to survive.

The Brent graph is published daily by the Wall Street Journal. It is acknowledged with gratitude.