Hollard claims 20% market share

A critical part of Hollard Insurance Namibia’s success is its specifically Namibian pedigree, says Hollard Namibia CEO Johan Barnard.

The company’s staff complement has grown similarly, from six people in the Windhoek office to 125 employees in 12 offices, across 10 towns and two countries.

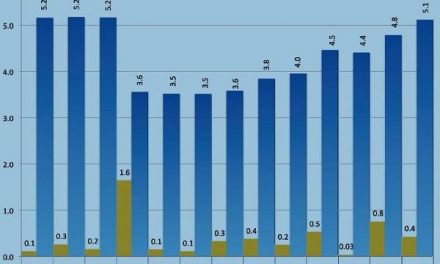

In the past five years the short-term insurance business has grown at a rate of more than 19% per annum, and now has representation in eight Namibian towns. The life insurance company was founded in 2009 and currently contributes nearly 25% of total premium income in Namibia; a life company was established in Zambia in December 2012, following the opening of the short-term company in 2010. The Zambian operations are wholly owned by Hollard Insurance Namibia.

Hollard says it has paid more than N$280-million in taxes, levies and fees over the 10 years of its existence, in line with its commitment to being a sound corporate citizen. The past decade has also seen Hollard Insurance Namibia develop local skills, from administrative to managerial and key decision-making positions.

CEO Johan Barnard said “Hollard Insurance Namibia was established with a key pillar being that we would be our own entity – an insurance company with a local Namibian flavour. That meant employing local people and finding local solutions to our clients’ insurance issues, but still having the capacity to leverage off the experience and expertise of our South African shareholders.

“It is a model that offers clients the opportunity to choose insurance that relates to their needs, while also allowing us to use our entrepreneurial skills and build a local Namibian company. This innovation has seen Hollard Insurance Namibia sourcing goods and services from local suppliers even if that comes at a small premium, because supporting local business is vital.”

Barnard says that his team is “passionately Namibian” and dedicated to decision-making in the interests of their country, is a game-changer for Hollard Insurance Namibia. “Everyone is committed to being good corporate citizens; paying the required taxes and levies in Namibia; employing local people and being active in community work. All this would be difficult if you had a foreign head office, trying to extract as much value as it could,” he said.

One community initiative of which Hollard Insurance Namibia is particularly proud is the Amos Meerkat School project – a rural farm school scheme that trains illiterate and semi-literate mothers to teach farmworkers’ children to become school-ready. Barnard says that in the first year 48 teachers attended the training, and 40 schools were established on farms by a 10-women strong team of dedicated past teachers.

Other social investments have included school projects, school sports and church group initiatives. Hollard Insurance Namibia also sponsored the visit of the Kaizer Chiefs soccer team to Namibia, and now partners with Namibian premier league clubs.

The company also participates in traditional authority events.

Looking ahead to the company’s second decade, Barnard said they will not stop being a catalyst for “positive and enduring change” and will not stop building and developing its team; it will not compromise its relationships because “Hollard is about more than just getting things done.”