Grooming top corporate clients

Werner Weber is the Head of Corporate and Investment (CIB) at Standard Bank Namibia.

“Key to our strategy is the combination of on the ground knowledge with global and intra-Africa specialist knowledge and also to deliver best solutions to our clients in a globalizing environment. We are proud to be able to deliver sessions of this quality to our top clients and believe it will assist them in becoming more globally competitive,” said Werner Weber – Head of Corporate and Investment Banking at Standard Bank Namibia.

Standard Bank’s Corporate and Investment Banking division recently held successful information sessions for its top CIB clients in Windhoek and Walvis Bay. Keynote speakers from Namport, Nampower, Swakop Uranium and Transnamib also shared valuable information on the latest developments in their sectors.

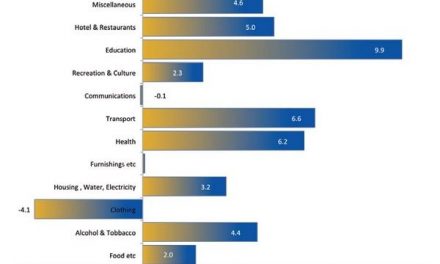

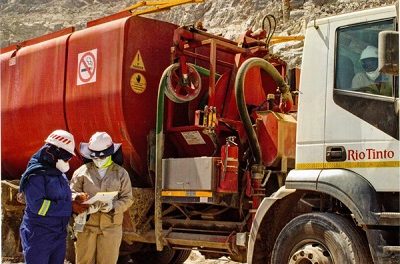

In her presentation “Southern Africa – The Rise of New Giants” Standard Bank’s Senior Economist and Africa Strategist, Yvette Babb argued that natural resources still remain a main driver of private investment in the region, while infrastructure spend is highly supportive of growth in short to medium term.

“Strong growth in volumes of natural resource output, particularly oil, coal and copper will support growth. At the same time private and public investment in association with transport infrastructure will also provide significant growth boost to economic activity,” said Babb.

Southern Africa’s growth is estimated to remain below 5% for the next five years. Therefore experts feel regional integration remains key in creating economies of scale while facilitating trade and investment. Babb stated that initiatives by regional economic communities should seek to promote greater intra-Africa trade and investment in the region.

According to Standard Bank’s Regional Head of Transactional Products and Services Prakash Punjabi trade finance is growing in importance and complexity when looking at major trends of regulation, technology, customer needs and competitive dynamics.

“As the largest African bank represented in 18 countries in Sub-Saharan Africa, we are increasingly providing value added and integrated solutions to meet clients dynamic requirements for trade finance. Integrated solutions guarantees working capital funding and risk management and we understand the complexities and risks of trading in Africa and we strive to improve your cash flow by ensuring payment process and terms,” said Punjabi.

“This outlook is welcoming given the fact that trade flow analysis shows that South-South trade has grown, lifting African trade overall,” he highlighted. Punjabi’s presentation covered “Trade opportunities in Namibia, Trade with China and Standard Bank’s Capabilities.”