You have to be nuts to bring Africa the type and the volumes of capital she needs for the next 100 years

A concept that is so simple but at the same time so meaningful, crossed my desk this week. At first, it did not trigger a switch in my mind, but then, while working through the report, it became clear that this is precisely what we need in Africa. I am talking about Patient Capital.

The only problem is that Africa is far too big and too complex to absorb a meaningful level of patient capital.

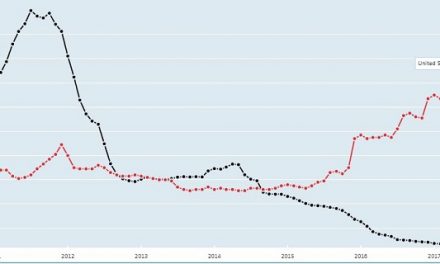

Typically, capital is not patient. It is always looking for a place to work, and it demands a certain compensation for working. But when there is so much capital in the world, and the returns are so tiny in the developed world, then it makes sense to send that capital to places where the development journey has just begun. However, for that capital to really benefit from Africa over the next half a century, it has to be patient – very patient.

I suppose there is a similarity between development capital and venture capital although the latter does not necessarily have ultra-long horizons. In my mind, venture capital is like betting on all the horses on the assumption that at least one horse must win the race while development capital is not betting on any horse at all, but making sure that the racecourse is in order.

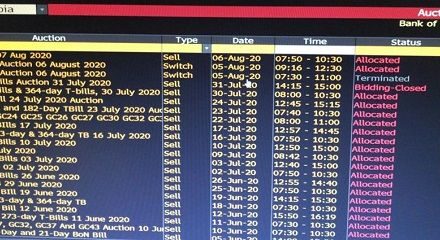

Given that several sovereigns have lately started issuing 100-year bonds, the idea of patient capital is not that novel. But here again, the capital is not that patient. The maturity may be a century, but the returns are not. Bondholders are regularly paid by the issuers, and when the investor’s patience runs thin, the holdings are simply liquidated.

So, essentially that is also not what we need in Africa. We need really patient capital from really patient investors.

I can only picture the response when approaching a fund manager, asking him or her to tie down a chunk of the investments for fifty or a hundred years, without the typical escape routes available in bonds or securities. He or she will ask you not too politely: “Are you nuts?”

Perhaps the terminology is out of kilter. Perhaps it is not funding we need, in the sense that we create capital markets and then entice investors to sample the ware. No, African capital markets are so far behind developed capital markets, that we will never raise the type of money we need through conventional channels.

Every time I read an assessment or an estimate of Africa’s development capital needs, I stagger. The amounts are simply mind boggling. In fact they are so huge, I am wondering whether it makes any sense at all to look at the continent as one big union, and then trying to determine what the development needs are.

These two realities – the nature of capital and the volumes we need – are what will eventually force us, regardless of what is claimed for the African union, to turn our attention, our efforts and our energy to specific regional clusters. I cannot see any organisation anywhere in the world, making available some blanket arrangements so that the continent as a whole can just tap into this pool. Aint gonna happen!

But if you parade the Southern African Development Community before the world’s huge investors, then suddenly the picture that emerges, is far more manageable. And this approach can be replicated for the other development corridors in Africa.

First, SADC has structure. Second, it is founded on a number of multi-lateral agreements supported by a large majority of members, third, the community has common development goals which are well-defined and over which there is a large measure of agreement, and fourth, many institutions and multi-nationals already operate in most of the member states, utilising financial services that are basically the same across all member states.

The point is, what we may be lacking at continental level already exists on regional level. The only thing we need now is for investors and development partners to shift their view from the continent to the regions. Looking at the continent as a whole, out future seems almost unmanageable. Looking at the development corridors (communities), it is obvious that they have progressed much further and are ideal investment targets for a very long time.

All we need is for the stewards of development capital, also to realise the common sense logic of this approach.