Mufhiwa Building Projects ordered to cease operations

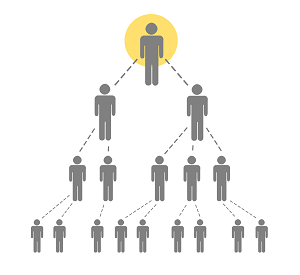

The Bank of Namibia has instructed Mufhiwa Building Projects to cease business operations in Namibia immediately, after investigations found that the business operates as a pyramid scheme.

Members of the public are also instructed to stop participation in this scheme with immediate effect. In December 2020, the Bank issued a public statement in which it stated the business activities of Mufhiwa Building Projects constitute and resemble a pyramid scheme and directed promoters and participants to stop their operations in Namibia.

In the same statement, the Bank appealed to Directors or duly authorised representatives to contact the Bank within a prescribed period from the date of issuance of the statement, in order for the Bank to consider the matter in terms of the provisions of the Act.

Accordingly, Directors and duly authorised representatives contacted the Bank, and presented the business model of Mufhiwa Building Projects. Subsequently, the Bank made an assessment in accordance with the provisions of the Act.

The assessment has revealed that the business activities of Mufhiwa Building Projects constitute a pyramid scheme and contravene section 55A of the Banking Institutions Act, 1998.

The investigation found that members and participants in Mufhiwa Building Projects are encouraged to recruit new members, upon a payment of a joining fee of N$200.00, with the promise that such members receive payments to have their home loans settled, or to purchase new houses, or to renovate their existing houses.

Mufhiwa Building Projects does not generate income through the sale of a product or any service to its members and the joining fee of N$200 is used to pay existing members and the directors or owners of the scheme.

Therefore, as soon as the recruitment of new members stops all the members and participants in the scheme will not receive any payment and will lose their joining fee.

“The public is urged to make the necessary enquiries from the Bank, about businesses with similar characteristics/business activities before participating in such business activities.

The Bank remains committed to protecting consumers from fraudulent pyramid schemes as mandated by law,” Kazembire Zemburuka, Deputy Director of Communications at the Bank of Namibia said.