Fitch affirms Namibia’s credit outlook at negative

International rating agency, Fitch Ratings has affirmed Namibia’s long-term foreign-currency rating at ‘BB’ with a negative outlook, due to a continued rise in general government debt driven by persistent wide fiscal deficits and a protracted recession aggravated by the coronavirus pandemic shock.

Fitch said the rating also reflects challenges to fiscal consolidation from a difficult social context marked by a particularly high level of inequality.

The countries government debt has been steadily increasing since end of 2014/15 financial year, despite significant measures towards fiscal consolidation, illustrated by a 7.6% of GDP narrowing in the primary balance excluding transfers from the South African Customs Union between financial years 2015/16 and 2018/19.

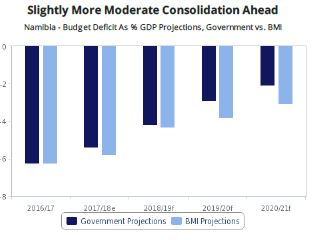

Fitch projects government deficit to double to 10.7% of GDP in 2020/21 from 5% of GDP in 2019/20, exceeding the forecast ‘BB’ median of a 7.8% of GDP deficit in 2020.

The government is preparing to refinance part of the US$500 million Eurobond principal repayment coming due in November 2021, possibly through international market issuance, to avoid a sharp international reserve drawdown.

The authorities have also applied for a USD192 million (1.7% of GDP) loan from the IMF under the Rapid Credit Facility and N$5 billion (2.9% of GDP) under the African Development Bank’s Covid-19 Response Facility. They expect both loans to be disbursed in two equal tranches, in 2020/21 and 2021/22.