When business confidence has been destroyed, demand for credit evaporates, as can be seen in the data

Nowhere is the devastating impact of the protracted lockdowns more evident than in the latest figures from the Bank of Namibia for new credit to the private sector, including both households and businesses.

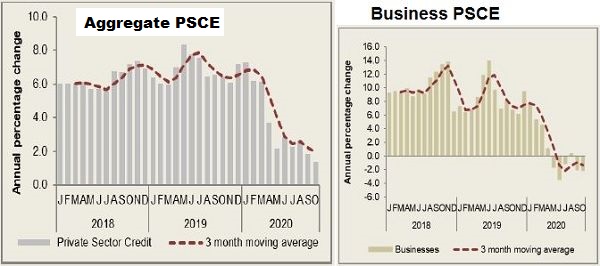

The two graphs at the top paint a dismal picture of what has transpired this year. The graph on the left is gross Private Sector Credit Extension and on the right, monthly growth in new credit to businesses year on year.

What one must notice first is that credit to businesses has basically stalled. The monthly year on year change is negative for five of the past seven months. At the end of October and the end of September, the rate at which new credit was extended, has shrunk by 2.2% for both intervals.

At the beginning of the year, it was still positive for January, February and March but the trend was stalling. In April is was marginally positive, before it turning negative for the first time in May.

Comparing the two graphs, one comes to the realisation that the private sector is taking up less and less credit and that the marginal overall 1.4% growth in credit comes mostly from private households. But even new credit to families, or natural persons, is not fantastic, in fact the 4.2% growth is also dismal considering the rate of credit growth of the past 20 years.

These statistics are disconcerting in the extreme. The fact that the commercial private sector does not need credit shows the vast majority of businesses are scaling down, many of them having gone into distressed operations. And the somewhat better credit demand from private households indicate that many people are borrowing short-term against assets (collateral) to make ends meet and to survive.

When we go back in the history of Private Sector Credit Extension (PSCE), we see a picture vastly different than the one that has emerged this year. Even during the recession that started late in 2016, demand for credit was agreeably positive although not sterling.

When PSCE first went below 10% in 2017, it was viewed as a temporary disruption and that it would quickly revert to a more healthy 12%. This did not happen, in fact the demand steadily deteriorated during 2017, 2018 and 2019 to such an extent that we now regard a 6% growth as “ positive.”

But over a 25-year period, the economy has set some clear benchmarks of which PSCE is one of the more important. Before the 2008/9 world financial crisis, the typical growth rate, measured monthly year one year, was in the order of 13%. Averaging out the data, it indicates that the Namibian economy required annual credit growth around 13% to give us nominal growth of roughly 9% and real (inflation adjusted) growth around 3%. This is how the larger mechanics of the economy’s macro side work.

During and after 2010, with the so-called counter cyclical TIPEEG government budgets, the effect of stimulus clearly showed in PSCE data. Although it took the better part of 24 months, by the beginning of 2012, the economy was on a roll. In the meantime, PSCE has shot up to around 19% with a very brief period when it went to 21%.

This was the 2013, 2014 and 2015 years when nominal growth touched 18% at times and real growth came in at just above or below 6%. Then came the crunch in the second half of 2016 which continued until we hit the start of the Covid phase in March this year. Then the economy basically collapsed. This is also attested by other statistics but it is most vividly shown in the almost complete lack of appetite for new credit from businesses as well as households.

Ultimately, the figures show me business confidence is down the drain. How to restore confidence is not an easy question or undertaking. I doubt confidence will be restored overnight but I am very careful not to state that it will take two or three years.

As a matter of fact, general economic conditions have been disrupted so severely, any too optimistic take on the future, based on projections, is an exercise in pure speculation. No one knows how the short to medium term will play out.

And as long as that continues, business will not invest and will not borrow. After all, who is going to make a major financial commitment when prospects are as bleak as they are right now. It will take more than just another National Development Plan, or more sovereign debt, or whatever, to restore confidence. That will only come when businesses are profitable again, and when that happens, it will immediately show up in the PSCE data.