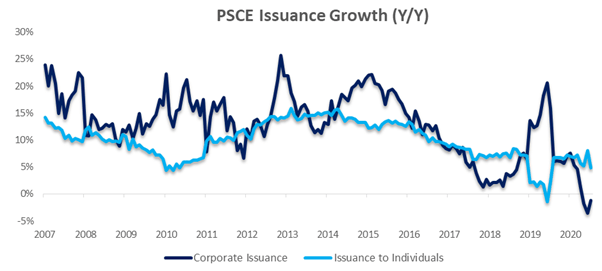

July sees robust lending to individuals as private sector credit continues to stay subdued

The private sector credit extension growth remains subdued at the end of July, down slightly to 1.9% (N$476.2 million) from 2.3% (N$408 million) in June, according to the central bank.

This July figure brings the cumulative credit outstanding to N$102.24 billion. July 2020 represents the second-lowest level of annual growth on record dating back to 2002.

During the period under review, lending to individuals has been relatively robust, given the economic climate, showing some growth in the mortgage segment.

However, IJG Researchers noted that the sharp increase in other loans and advances should be viewed with caution, as this likely indicates that most consumers remain very stretched.

On the other hand, the decline is most evident in the corporate sector as economic activity remains muted and businesses remain very cautious during the uncertainty surrounding the pandemic.

“Current expectations are for interest rates to remain at the current low levels for at least the next 12 months, however low-interest are not enough to spur on lending at the moment and corporates are decreasing their long term debt,” IJG said.

The firm said that overall, there are very few catalysts for growth at the moment and while uncertainty looms investment will continue to suffer.

“As a result we not expect to see a recovery in credit extension in the medium term,” IJG added.