Local bourse plummets 20% in a single day

Volatility is not the hallmark of the Namibian Stock Exchange but on Thursday, 16 July it posted its biggest daily drop since the exchange’s inception in 1992. By late afternoon it became apparent that the index is in for a bloodbath after more than 2.6 million Namibia Breweries shares changed hands in only five deals but dropping the price by almost 25% from N$34.50 to N$25.90.

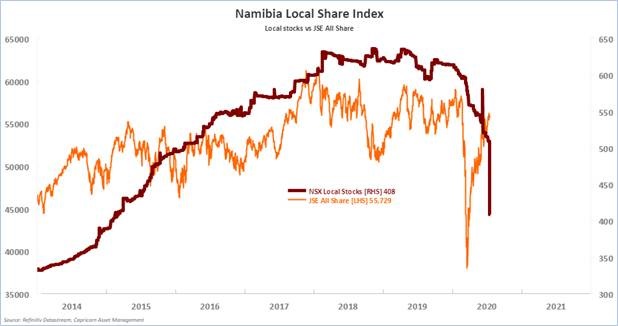

As a result, the NSX local index went from 509.06 to 408.02, shedding 101.84 index points and dropping 19.85%.

Another share that also took a beating is FirstRand Namibia, down 35% from N$31.00 to N$20.15, but the volume was less with 925,525 shares changing hands in a single deal.

Capricorn Group Ltd also did not escape the carnage but the volumes were modest with a mere 20,500 shares traded in three deals. The price however went from N$13.99 to N$10.50, a 25% drop.

For the other seven shares on the local index, the prices remained unchanged but only because there were hardly any transactions in any of these shares. The exception is SBN Holdings Ltd which saw a single transaction comprising a paltry 545 shares but the price held steady at N$7.25.

Floris Bergh of Capricorn Asset Management, in his regular early-morning market note said “We suspect that what happened on the NSX on Thursday is that one big portfolio liquidated its holdings almost at any cost. There were only a small number of trades amounting to N$122m. Again, given illiquidity, this means that share prices were severely compressed in order to entice a buyer or buyers.”

“What happened on stock exchanges worldwide in February and March of this year, waited until July to happen on the Namibian Stock Exchange. For instance, the JSE All Share Index fell by 34% from mid-February to Mid-March, with similar moves on other exchanges as the Covid related lockdowns decimated economies. Listed companies’ profitability was hit heavily as well as their ability to pay dividends to shareholders. Many firms from banks to property companies have indicated that they will forego paying dividends in order to protect cash flows and balance sheets,” he commented.