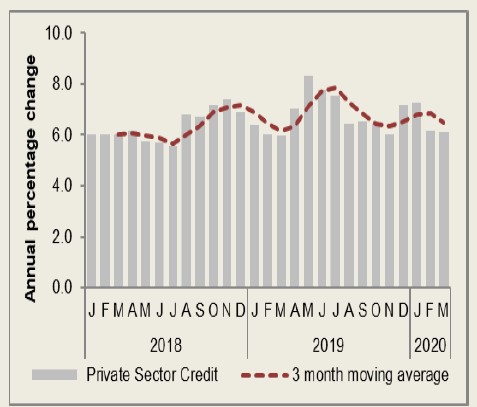

Private sector credit extension remains unchanged in March

According to the latest statistics by the Bank of Namibia, growth in credit extended to the private sectors was 6.1% at the end of March 2020, unchanged from a month earlier.

The central bank said the stable growth reflected the increase in credit extended to households offset by a decrease in demand for credit by businesses during the period under review.

Growth in credit extended to households rose to 7.2% at the end of March 2020, slightly higher than 6.7% at the end of the preceding month, largely due to higher demand for mortgage loans, coupled with a robust growth in overdraft credit during the period under review.

“This may suggest financial strain (particularly in the case of overdraft credit), due to lower income amid low economic activity,” the Bank of Namibia noted.

Meanwhile growth in credit extended to businesses slowed to 4.6% in March 2020, from 5.4% a month earlier, mainly due to repayments in short-term credit facilities (i.e. overdrafts and other loans and advances), coupled with lower demand for mortgage loans.

Additionally, the central bank noted, the persistent contraction in instalment credit since 2017 contributed to the decline in demand for credit by businesses during the month under review.