Investors punish Trustco for intangible structure of a series of complex deals

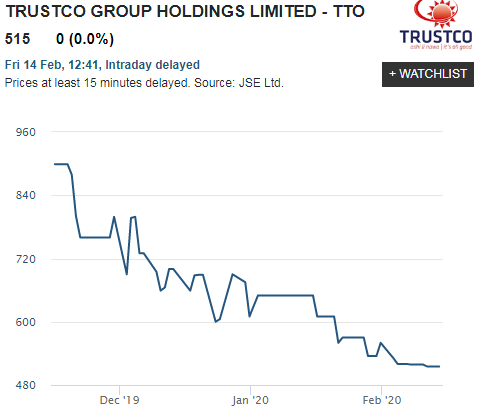

Unravelling the ball of spaghetti that is the latest round of complex Trustco shareholder dealings, is an arduous task. For this complexity, the company is punished severely by investors. The share has lost more than 60% of its value from its lofty highs of N$16 per share at the end of 2018.

On Friday 14 February 2020, Trustco Group Holdings Ltd (JSE: TTO) was trading at a recorded N$5.15 per share except there were no deals. The share has basically flatlined for the past two weeks after a gradual but persistent decline since Trustco announced a number of pending deals, via the Stock Exchange News Service (SENS) of the Johannesburg Securities Exchange.

A single buy offer of N$3.42 per share provided an indication of how low investors valued the pending Trustco deals.

The first deal is the acquisition of 100% of the share capital of Constantia Risk and Insurance Holdings Ltd, a loss-making entity, for a consideration of over N$2 billion. This will however not be fully paid in cash but effected through a share transfer from Trustco Property Holdings Ltd to Constantia for an agreed consideration of N$1 billion.

Trustco Property Holdings is in turn a wholly-owned subsidiary of Legal Shield Holdings, which is also the vehicle for the Group’s investments in resources.

In another deal, the group is consolidating its financial services holdings in Trustco Bank and in insurance under the Legal Shield shell to, as they stated, offer a fully integrated financial services entity.

Adding more complexity to the deals is the fact that a major Trustco shareholder, the Riskowitz Value Fund, holds more than 35% of the shares in the Constantia owner, Conduit Investments. It has two wholly-owned subsidiaries, Constantia and Conduit Ventures, both of which are to be taken over by Legal Shield.

The Riskowitz Value Fund also holds 32% of the share capital in Trustco Group Holdings and 20% in Legal Shield Holdings Ltd.

Another layer of complexity was added when the Trustco Managing Director , Dr Quinton van Rooyen announced earlier this year that he has waived an amount of N$1 billion owed by Trustco to his private investment company, Next Capital Ltd.

However, the pinnacle of confusion was reached on Thursday this week when Trustco announced the closure of the Huso deal for which the incumbent MD will be paid by issuing more Trustco shares and transferring these to van Rooyen and his designated nominees.

“The Seller has nominated Next Capital Limited, Nilgiri Investments CC, Othinge Investments (Pty) Ltd and Seawfell Investments CC as its nominees which are all considered Extended Family as defined in terms of the JSE Listings Requirements, to whom the Trustco shares (“New Trustco Shares”) shall be issued,” according to the SENS.

Upon completion of this deal on 19 February 2020, the number of Trustco shares in issue will have increased from around 827 million in 2016 to just over 1.6 billion.

For a group that was N$150 million cash negative in 2018/19 according to their Annual Financial Statements, the number of deals cited in the billions, and the obfuscation around share transfers, do not convince investors. Of this the share price performance is tangible proof.

TTO share price graph from sharenet.co.za