Excellent results at Opuwo Cobalt prompt Celsius Resources to look at ore processing options

The Australian prospector digging for cobalt, copper and gold in the Kaokoveld, Celsius Resources Limited, stated at the end of January that it has obtained excellent results from the Chirumbu drill site with 13 samples showing gold of above 1g/t and 37 samples with copper of more than 1% mineralisation.

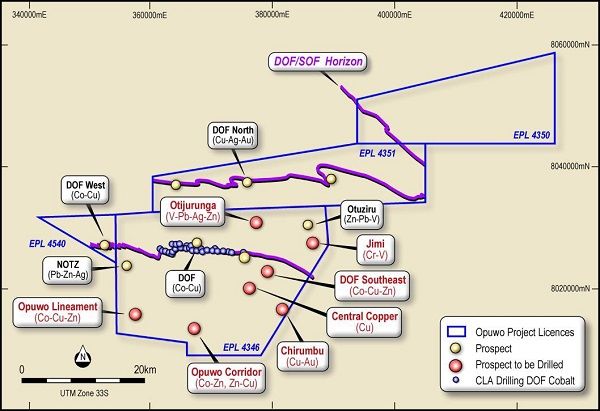

These results were achieved during the last quarter of 2019 as the company consolidated and realigned its extensive drill programme at existing sites, at the same time extending its rock sampling in the broader Opuwo Project to gain a better understanding of vein structures.

“During the Quarter excellent results were returned from sampling at Chirumbu with 13 samples above 1g/t gold and 37 samples > 1.0% copper . These included peak values of 56.9g/t gold in sample AR022 and 36.9% copper in AR112,” the company stated in its investor update released on 30 January 2020.

“Mineralisation at the Chirumbu Gold-Copper Prospect has previously been determined to be hosted in carbonate-quartz veins and systematic rock chip sampling of outcropping and sub-cropping veins was completed to provide an increased sample coverage to provide a more robust interpretation for the orientation of mineralised structures at Chirumbu.”

Celsius Resources is focussing its exploration activities on two zones to improve its understanding of the spatial relationship of the identified mineralised veins.

“During the Quarter Celsius continued exploration activities focused on locating potential feeder zones for the Opuwo Cobalt Deposit. The aim is to identify higher grade zones which would enhance the viability of the Opuwo Cobalt Project.”

In the meantime, Celsius has appointed HiSeis Pty Ltd to determine the potential success for seismic scans by reviewing stored drill cores to determine if specific areas contain enough hard rock to act as a seismic deflector. HiSeis will start this survey during February.

Preparing for limited mining as allowed under the company’s four Exploratory Prospecting Licenses, Celsius said it has received tenders from independent mineral processing companies in Australia, South Africa, North America and Europe. A final recommendation will be made soon to the board after evaluation and adjudication.

Although Celsius has stopped intensive on-site test work, it continues with trade-off studies to improve the project’s overall viability, stating that is has recently received the results of an OPEX and CAPEX study to determine the advantages of locating some or all of the processing facility closer to the harbour at Walvis Bay.