Average GDP declines in the last four years – Research Analysts

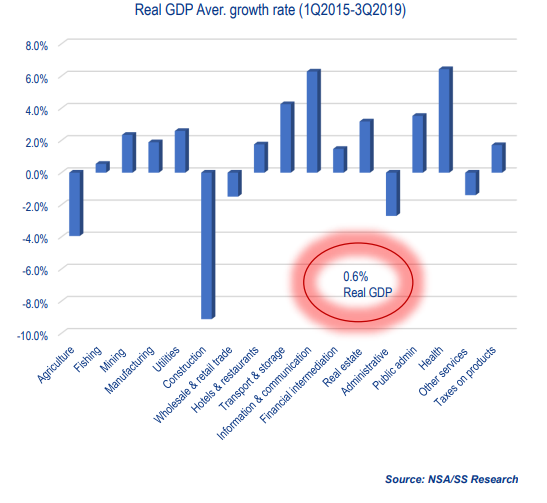

Research by Simonis Storm Securities shows that the average Gross Domestic Product (GDP) over the last 4 years declined to 0.6% compared to the long-term average of 3%, with the biggest decline on average recorded from the construction, agricultural, administrative and wholesale and retail trade sectors.

The wholesale and retail sector, which is the biggest contributor to real GDP, has been on a decline due to lower spending caused by high unemployment and consumer indebtedness.

Furthermore, mining and manufacturing sectors, contributing each about 10% to real GDP, are facing structural challenges.

“Weak commodity prices coupled with mines going into care and maintenance (Langer Heinrich and Trekkopje) and facing possible closure (Weatherly and Scorpion Zinc) are threatening the medium term growth of the sector. Weak and unclear policies and regulations are some of the contributors to a struggling sector,” Simonis Storm indicated.

The firm however expects a small recovery in the agricultural sector as live-stock farmers restock, stemming from normal-to-above-normal rainfall that can be expected in the first quarter of 2020 in northernmost and central to southern parts of Namibia, which could provide respite to the crop farmers.

Additionally, the construction sector is expected to rebound as the African Development Bank loan gets disbursed to fund road and rail construction.

“We therefore expect the economy to contract by 1.1% on a fair case scenario (currently leaning more towards -2% our worst-case scenario) in 2019 before it expands by 0.9% in 2020,” Simonis Storm noted.