Post office network becomes conduit for taking micro-finance to rural and remote areas

Another government guarantee was required in favour of the KfW German Development Bank but it has secured a concessional loan of N$325 million for PostFin, the Nampost subsidiary that acts as financial intermediary for small loans to employed people.

Last week Friday, 15 November, NamPost signed an agreement with KfW for the loan to provide small loans to SMEs and households in rural areas via the post office network of NamPost. This loan is envisaged to expand PostFin’s loan book over the medium term.

PostFin (Nampost Financial Brokers) makes term loans available ranging from N$750 to N$100,000 to employed persons or to SME’s with a proven income. It also offers debt consolidation and insurance services, operating country-wide through the extensive network of post offices. In this regard, it is the ideal financing vehicle to reach borrowers in the most remote areas.

The funds provided within the German development cooperation extend access to finance for up to 28,000 households and micro-, small- and medium enterprises, with a special focus on women and disadvantaged persons.

At the signing ceremony, PostFin Chief Executive Patrick Gardiner said that PostFin has a track record of providing micro-finance to Namibians, stretching back to PostFin’s inception in 2010 and specifically serves clients in the lower income groups who are partially or fully excluded by the formal banking sector.

KfW Windhoek outgoing Office Director, Dr Uwe Stoll emphasized that “NamPost with its main objective to contribute to poverty reduction and social development can now more easily fulfill its part ‘to leave no one behind’!

Gerlinde Sauer, Counsellor for Development Cooperation in the German Embassy highlighted the importance of access to finance for private sector development and employment creation. This loan complements the German Government’s technical cooperation with the Ministry of Industrialisation, Trade and SME Development, and the Ministry of Finance, for SME financing.

NamPost Chief Executive, Festus Hangula said the funding provides PostFin additional leeway further to develop and refine models and options to grow the PostFin project portfolio that focuses on financial inclusion and responsible financing.

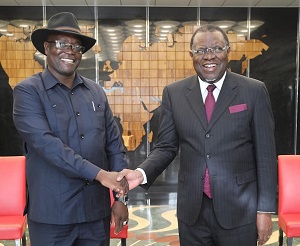

Caption: Access to micro-finance at work. From the left, Batsirai Pfigirai (NamPost Chief Financial Officer) – Andrea Uhl (Financial Sector Coordinator KfW) – Patrick Gardiner (PostFin Chief Executive) – Festus Hangula (NamPost Chief Executive) – Dr. Uwe Stoll (outgoing Country Director KfW) and Gerlinde Sauer (Counsellor for Development Cooperation in the German Embassy). © KfW.