Uranium hopeful commences with the accelerated work programme to advance Reptile Project

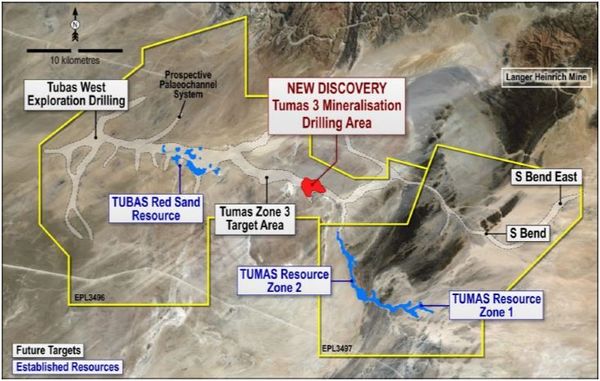

Uranium hopeful, Deep Yellow Limited has started with the accelerated work programme as announced on 24 September to advance the company´s Reptile Project in Namibia and determine, in a staged manner, the economic feasibility of the Tumas channel uranium deposits.

The company in a SENS announcement last week said the increased tempo of the work programme has necessitated the contracting of two additional drilling rigs and additional personnel to supervise their operation.

The incoming drill rigs comprise a second RC rig to accelerate exploration and resource drilling and a diamond rig specialising in soft core recovery to help with more detailed geological evaluation and to obtain sampling for metallurgical testing, they added.

“Originally, 10,800m of RC drilling were planned for the whole of the FY19 field season. This has now been upgraded to 22,000m of RC drilling and 600m of diamond drilling. It is scheduled to complete 10,800m of RC drilling by December 2019 along with 600m of diamond drilling. A total of 4,089m of RC drilling for 261 holes had been completed by 12 October 2019,” the mining outfit said.

According to Deep Yellow, the overall programme to December is aiming to increase the Inferred Resource inventory in the Tumas 1 East area and define areas for resource drilling west of Tumas 3 West in the Tumas Central and Tubas areas

An upgraded Mineral Resource statement is expected to be released early November, they added.

Meanwhile, the additional 11,200m of RC drilling, required to complete the revised FY19 programme, is planned for March to June 2020 to further increase the Inferred Resource inventory and convert some Inferred Resources to the Indicated Resource (JORC, 2012) status.

“The DDH drilling programme is required to confirm the current geological model of the Tumas paleochannel uranium mineralisation in detail and provide sufficient sample material to complete a metallurical test program for the planned Pre Feasibility Study in 2020,” they added.

According to the mining outfit drilling in 2019 is anticipated to be completed by early December.