IMF Executive Board concludes 2019 Article IV consultation with Namibia

[The IMF statement is republished verbatim below. The link to the IMF Namibia page is at the bottom of the article. It includes a list of selected indicators.]

On 30 August 2019, the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with Namibia and considered and endorsed the staff appraisal without a meeting.

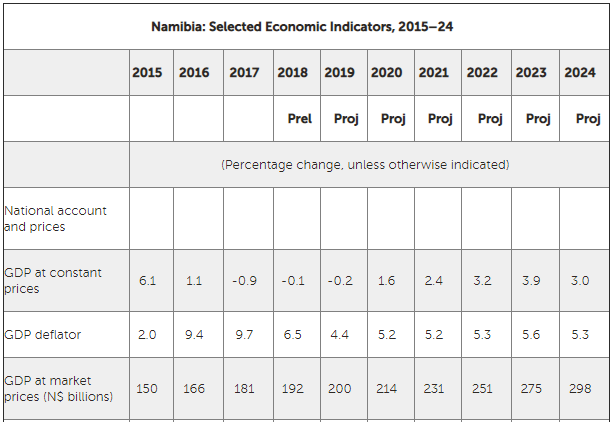

During 2010–15, Namibia experienced a period of exceptional growth but macroeconomic imbalances rose, resulting in public debt sharply increasing and international reserves falling below adequate levels. Rapid credit growth fueled fast-rising house prices and elevated private sector indebtedness. Robust growth masked slowing productivity growth and declining external competitiveness, hindering the long-term growth prospects of the economy. Income inequality and unemployment remained very high.

With the temporary stimuli now ended, the economy is rebalancing while the government is implementing a significant fiscal consolidation. Real GDP declined in 2017 and, at a slower pace, in 2018. The current account deficit has narrowed significantly, despite a decline in Southern Africa Customs Union (SACU)’s receipts. Credit to the private sector slowed and the house price real growth rate turned negative. The authorities have implemented significant fiscal adjustment. However, public debt remains on a rising path, and government’s growth financing needs are elevated. International reserves improved, although remain below adequate levels. The financial sector has so far been resilient, although with the economic slowdown, banks’ assets quality has deteriorated.

A likely slow recovery, the need for further fiscal adjustment to bring public debt to a sustainable path, persistent inequalities and structural impediments to growth, point to a challenging outlook. Real GDP is projected to mildly contract in 2019, before gradually recovering. Absent structural reforms, growth is expected to converge to a long-term level of about 3 percent, which is too low to deliver meaningful improvements in per capita income and reduce unemployment. Pending further actions, public debt would continue rising, although at a more moderate pace than in the past. While the current account deficit is expected to stabilize at around 4 percent of GDP, international reserves coverage would gradually decline.

Downside risks weigh on the outlook. Risks emanate from possible fiscal slippages that could trigger further debt increases; declines in SACU revenue; and, low demand for key exports due to rising trade tensions and weaker global growth. With a highly interconnected financial sector, macro-financial feedback loops could amplify the adverse effects of shocks.

Executive Board Assessment:

In concluding the 2019 Article IV consultation, Executive Directors endorsed staff’s appraisal, as follows:

Namibia’s economy is rebalancing, but significant challenges remain. After a period of exceptional growth and rising macroeconomic imbalances, public debt remains on a rising path, international reserves below adequate levels, and growth has come to a halt. Years of strong growth masked slowing productivity and declining external competitiveness, hindering growth prospects, while income inequality and unemployment have remained high.

The authorities’ fiscal consolidation objectives strike an appropriate balance between stabilizing public debt and supporting the economy, but actions are needed to deliver this outcome. In the short term, staff assess that an additional ¾–1 percent of GDP in measures is required to contain the FY19/20 fiscal deficit within the budget target. Policies to deliver the adjustment planned for the next two years (about 2 percent of GDP) also need to be fully defined.

Policies should combine spending reductions and selected revenue increases that can enhance the long-term growth prospects of the economy, while protecting the poor. Measures should include: continuing the authorities’ policy of containing salary indexation and new hires, applying the policy to all public entities; rationalizing transfers to public entities and enterprises; and, expanding tax bases by reducing exemptions and special tax regimes. Over time, these policies would help bring wage dynamics closer to the productivity trends, improve service delivery, and create a level-playing field for private investors, with positive effects on external competitiveness and long-term growth. Widening the coverage of children’s grants, better targeting of housing programs, and a more progressive personal income tax would help protect the poor and strengthen the distributive role of fiscal policies. In this context, the BoN should keep the policy rate broadly in line with the SARB’s rate and maintain the peg.

Fiscal reforms are essential for the success of the authorities’ adjustment plans. Rationalizing public enterprises and extrabudgetary entities, strengthening revenue administration, and improving budget and expenditure controls are critical steps to deliver the planned fiscal adjustment. To strengthen the credibility of the fiscal adjustment plans and reduce risks, it also important to control off-budget financing of investment projects, develop a fiscal risks framework, and publish a risks statement. In consultation with the authorities, a Fund’s medium-term capacity development strategy has been developed to support improvements in some of these areas.

Accelerating structural reforms would boost productivity and competitiveness and long-term growth, while supporting the fiscal adjustment strategy. Structural reforms should focus on reducing policy uncertainty and removing existing obstacles to stronger and more inclusive growth. Reforms should aim to: streamline business regulations (e.g., lowering regulatory compliance costs); reduce the high electricity and transportation costs (e.g., reforming public enterprises operating in these sectors); contain public sector salary dynamics to better align productivity and wage dynamics in the economy; and, avoid regulations hampering domestic competition (e.g., preferential procurement rules). Over time, it is important to reduce non-tariff obstacles to exports (e.g., quotas, imports ban, SACU-related restrictions); address shortages of well-educated and skilled workers through better access and quality of higher education, vocational and on-the-job training programs; and foster the adoption of new technologies (e.g., better broadband services). The potential gains from improvements in the above areas could be large.

Actions are needed to further strengthen the oversight of the financial sector, particularly of the large non-bank financial industry. Despite a recent increase in NPLs, the financial sector remains sound. However, with a large non-bank financial industry, planned legislative changes to address existing regulatory gaps in the industry (e.g., NAMFISA, Financial Institutions and Market bills) should be adopted expeditiously, while reviving efforts to introduce risk-based supervision. With the BoN set to have an explicit macroprudential mandate to regulate a deeply interconnected financial sector, the coordination framework between the BoN, NAMFISA and the Ministry of Finance should be strengthened, including through the creation of the planned Financial Stability Committee. Complementing the macroprudential toolkit with DSTI limits and other macroprudential measures would better manage risks from the highly leveraged private sector.

Finally, efforts to develop a full crisis management and resolution framework should be stepped up, including by granting BoN and NAMFISA full resolution powers of financial institutions, and operationalizing emergency lending assistance.