Sluggish consumer spending deters business confidence – research firm

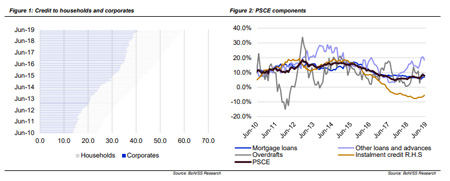

Private sector credit extension (PSCE) rose to 7.8% in June and the Bank of Namibia cited that the slow growth was mainly due to some repayments on short-term credit facilities by the business sector, particularly overdrafts.

According to the central bank credit extended to corporates made up 40.7% of the total private sector credit extension, while an increase of 8.4% to N$40.4 billion in June was recorded, lower than the 11.2% recorded in May.

The bank said credit extended to households made up 59.3% of the total PSCE as consumers remained highly indebted, while household credit increased by 7.3% to N$58.8 billion in June compared to a 6.4% rise seen in the prior month.

According to research by Simonis Storm Securities, the current tough economic conditions are expected to persist for the remainder of 2019 and businesses are likely to be badly affected by the continuous slow economic growth and lower consumer spending.

“Given the dire economic situation and highly indebted consumers, we will continue to experience sluggish consumer spending. This negatively affects business confidence and growth for the remainder of 2019,” said Indileni Nanghonga, Analyst at Simonis.

Nanghonga added that if the Bank of Namibia cuts interest rates by 25bps on 13 August, it will likely serve as a relief to households repaying mortgage debt.

“In addition, a slightly higher disposable income could marginally increase consumer spend, thus stimulating economic activity,” she said.