Better times for uranium

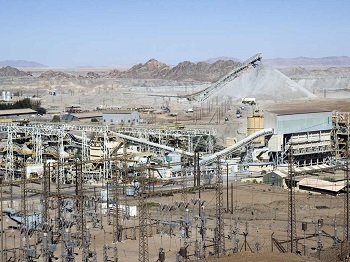

Recoveries in the mining sector coupled with increased productivity led to the 2012’s robust GDP growth. Yet a close examine of some of the sectors shows that this industry still faces trying times.

Uranium export earnings have been on a constant decline since 2010 according to Bank Of Namibia annual year report.

The earnings depend largely on the output and exchange rate between N$ and US$. This in turn depends on uranium price which is at the mercy of international market forces and speculation within the industry. According to Grant Marais, Director of Communications and Stakeholder Involvement at the Swakop Uranium institute, several variables come into play to determine the final uranium price. The decline in price over the past few years may be attributed to decrease in the demand of uranium. He also noted that overall supply has been increased with the transformation of weapons grade uranium into uranium suitable for nuclear reactors. This has kept prices at bay over the past few years. According to Marais, supply in this manner is expected to halt towards the third quarter of the year and this might lead to an upward push of the uranium price.

In the case of Namibia the depreciating Namibian dollar may hopefully improve export earnings this year. “Assuming that the price and output level of uranium remain unchanged, Namibia dollar depreciation (as was seen in early 2013), relative to the US dollar, will increase export earnings,” explained Ndangi Katoma, Director of Strategic Communications and Financial Sector Development. He said this bearing in mind that cost push factors do not hinder production within the industry which Marais noted was a huge problem affecting production. With Uranium production contributing significantly to the total export earnings (15% on average) , sentiment amongs the analyst state that the best remedy for the industry is a revived demand.

According to Katoma, “The Fukushima Daiichi nuclear disaster in March 2011 has resulted in decreased interest in nuclear power, with much of the world looking to move away from nuclear energy over coming years.” This can be seen with the “nuclear power phase outs” which is a discontinuation of reliance on nuclear power for energy production. Despite the nuclear power phase outs like in Germany, the market still indicates that demand for uranium might revert to its former high levels. China, USA which are some of the worlds largest consumers of energy are still hitched on nuclear power. Britain and even South Africa have shown interest over the past years in nuclear power and have projects underway that might lead to increased in demand and therefore price of uranium. “Bear in mind uranium price is also based on perception. All that is sometimes need to push prices up is talk of increased demand and not necessarily an actual increase in the demand,” explained Marais.