GIPF soars to N$61 billion

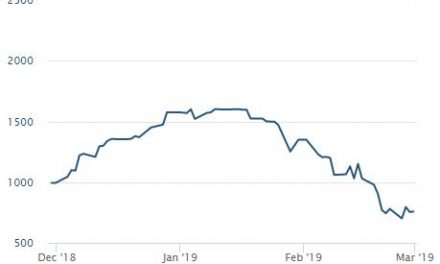

A combination of a weaker Namibia dollar, “buoyant” equity markets and inflation linked bonds have helped the Government Institutions Pension Fund’s (GIPF) market value to soar 23.04% to N$61 billion compared to the previous period, the fund said this week.

In the period under review, the GIPF continues to outperform Namibia balanced funds with annualised returns of 23.05% compared to 18.38% of the Namibian balanced average while having a significantly lower risk.

Elvis Nashilongo, the Acting General Manager: Marketing and Corporate Communications told the Economist upon inquiry that the fund’s big jump in value is a result of a combination of equity markets performance, a depreciating currency and inflation linked bonds.

Nashilongo said: “Not only have equity markets world-wide been buoyant, but the depreciation in the currency along with strongly performing low-risk asset markets, like bonds and inflation linked bonds, have all done well over the last 12 months. Nashilongo added that since 34% of the fund’s investments were outside Namibia and South Africa, the depreciation in the currency benefited the fund as expected. “Kindly note that the currency a year ago was viewed to be at very high levels, and open to depreciation risk,” he said.

CEO David Nuyoma said the soaring value is a result of the fund’s investment strategy that takes into account the dynamic nature of the market environment. “In this regard, the fund has implemented the specialist manager approach in order to access the best skills available in the market for a variety of niche investment mandates.” Nuyoma added that the return on the fund’s assets is particularly pleasing when seen against the backdrop of significant market uncertainty.

Nashilongo said the fund, which has a 78% exposure to equities, was not worried of the low performing equity markets across Europe. He said the GIPF’s investment strategy is a long term strategy, and should not be affected by shorter term fluctuations.

“It is impossible to change R62 billion over night to anticipate short term market movements. Secondly, European equities form only a small portion of the portfolio. Thirdly, the portfolio of equities is well diversified and in many areas and industries. This does not mean the portfolio does not carry risk, but it is viewed that this overall exposure over a 3 to 5 year view will benefit the Fund.”

But while the fund has performed very well compared to other pension funds internationally, there has been a slow uptake of funds in the its unlisted investment strategy. Last year, the GIPF made a commitment to invest 15% of total assets in local assets. These are split up as 5% in Private Equity in Namibia, 5% in Property in Namibia and 5% in Private Equity in Africa, but currently only 2% of total assets have been invested in private equity. Nashilongo explained that the initiative is progressing at a slow pace due to problems related to deal sourcing and the finalisation of actual deals.

“Another impediment is the enactment of Regulation 29, that has in fact been lodged with the Minister of Finance for signing. As long-term investors, we are cognisant of the fact that we need to ensure that the transactions that we do are in line with our philosophy and that they comply to all acts and regulations,” he said.