Equity investor Stimulus’ revenues take a nose dive as recession drove underlying asset performance down

“The negative macro-economic environment in Namibia resulted in the 2018 calendar year being challenging for most Namibian businesses. GDP growth was negative, consumer confidence was low, and policy uncertainty negatively impacted companies’ strategic deployment of capital. Although liquidity has improved, the Namibian economy remains in a vulnerable position and the outlook over the short- to medium term remains challenging,” said Stimulus Investments Ltd when releasing its financial statements for the year ended 28 February 2019.

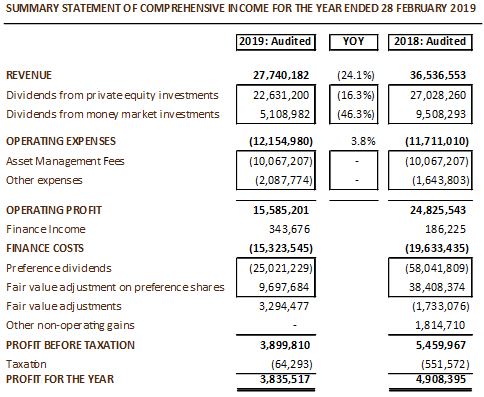

A slump in revenue of just over 24% coupled with a 3.8% rise in fairly inelastic operating expenses, resulted in a massive 37% decline in operating profit. After providing for finance costs and valuation adjustments, Stimulus’ profit before tax plunged from N$5.5 million in the 2018 financial year to a mere N$3.9 million this year.

As an equity investor, Stimulus did not escape the impact of the recession which was transmitted through its underlying assets in companies affected heavily by the slump in retail and construction.

“Stimulus’ investee companies have not been immune to the economic downturn and the underlying portfolio growth remained negligible,” the equity investor stated.

Stimulus Investments Ltd is Namibia’s largest private equity fund constituting roughly 43% of the total Namibian private equity market.

Stimulus is invested in eight companies with shareholding ranging between 20% and 100%. Uninvested capital makes up only 9% of total portfolio value indicating that it is essentially fully invested. In the 2019 financial year, Stimulus deployed additional capital of only N$20 million showing just how limited fair value investment opportunities were.

Citing the urgent demand for rationalisation, Stimulus said its team continued to apply its efforts to provide strategic guidance to ensure that each portfolio investment is optimally positioned, both strategically and operationally to overcome current conditions most effectively. A large measure of its focus is to ensure that its underlying assets are optimally positioned for accelerated results once economic conditions improve.

Confirming its commitment to achieve the best long-term outcomes for both its investors and its underlying investment assets, Stimulus said the combination of investment patience and experience have contributed to make it Namibia’s biggest private equity investor.