A capital tsunami is growing and it could wash over the entire world

While most of the attention is on Cyprus and Europe, a much larger catastrophe is being brought to a boiling point on the other side of the globe.

With a government debt of around 220% to GDP, the new Japan government is playing follow my leader to the Federal Reserve’s Chairman, opting to aggressively stimulate the Japan economy, a strategy that flies in the face of all rational economic considerations.

Depending on which metric one applies, the US government has debts and liabilities of around 90%, which are expected to cross the 100% mark within the next two years. This excludes entitlements and social insurance liabilities.

The Japan government is for all practical intents and purposes bankrupt. Its economy carries a debt burden that cannot be repaid by the next three generations. So, while Cyprus has kept the European Central bank occupied, it has shifted the spotlight temporarily away from Greece despite the fact that worthless Greece government paper is the fundamental reason why two Cypriot banks are bust. And skillfully maneuvering in the brief shadow cast by events in Europe, the Bank of Japan announced its own liberal Quantitative Easing programme on Tuesday catching most market players unawares, sending the Nikkei up by more than 3% over two days.

These events are far from our horizons but they should not be off our radar. Measuring only industrial output and exports, China overtook the Japan economy in 2011 to become the world’s second largest economy after the United States. But using other conventional metrics, especially currency in investments, the Japan economy is still number two. In simple terms, while the China economy produces more than the Japan economy, the latter still enjoys the benefits of a currency that functions as the second most important currency for international trade and savings. And depending on the view of the school one follows, it will take many years for the Renminbi to catch up with the Yen. Before that can happen, capital controls will have to go in China, and I do not see that happen soon.

The Japan economy and the Japan bond market has morphed from a stagnant animal into arguably the single most unstable element in the international economy. When the Japan bond market goes, a very large chunk of the world’s capital goes as well. Complicating matters further is the fact that China is a major supplier to manufacturers in Japan, and these deals are mostly done in Yen.

Analysts that pay attention to large movements in international capital flows, for years have been warning that the Japan bond market is not to be trusted as an investment platform. But, similar to the US, the Japan government needed and continues to need investments from the rest of the world, to keep their own interest rates affordable to themselves. As the Japan bond market slowly absorbed the savings of its citizens, investors typically did not care too much. But that font has now dried up and Japan is as dependent on international capital flows, as the US economy, or any of the “still strong” economies in Europe.

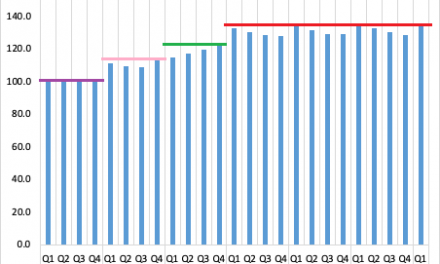

The benchmark interest rate in Japan is zero. The rate on 10-year Japanese bonds is less than 1%. The strategy the Bank of Japan announced this week will double its monetary base by the end of next year. If interest rates on the 10-year bond only increases to 1.5%, it doubles the interest burden on Japan’s debt. European governments that suffer under excessive debt would only be too glad to have a long-term interest rate of only 1.5%, but in Japan, this rate will be disastrous. If interest rates in Japan were to head for 2% or 3%, it will lead to an almost immediate economic meltdown.

Using bond market rates in Italy and Spain as a benchmark, Japan should certainly pay more than 5% on its debt. Such an outcome will force the Bank of Japan to turn open all taps and flood the world with Yen. As a consequence, it will become weaker by the day, setting in motion an unstoppable spiral of which the ultimate result will be the Far East’s first Weimar Republic.

There are many analysts who feel this week’s move is the beginning of the end for Japan. But there are just as many who are far more reticent and too careful to sketch a quick scenario. Japan has confounded the world’s investors for too long to draw any fast conclusions. But at this point, it is not far-fetched to say Japan is the most unstable country in the entire world. When a bond market implosion happens, it will be unexpected by most, it will be fast and it will be brutal.

We need to take note of events in Japan. It carries the potential to expose us to a severe calamity, the shock waves of which will make the 2008 financial crisis seem like a ripple on a pond.