Sanlam economist says weak Rand good for trade balance

“South Africa is running a wide current account deficit (-6.5% of GDP in the 4thquarter of 2012). Hence, the country has insufficient domestic savings to fund investment. Of late, it appears as though these foreign capital inflows may have slowed, causing the Rand and hence the Namibia Dollar to depreciate. But the weaker currency should help improve South Africa (and Namibia’s) trade balance as the year progresses,” said Arthur Kamp of Sanlam.

The chief economist of Sanlam Investment Management (SIM) shared his views on the Namibian economy at a recent dinner for SIM stakeholders. He made the comments to the Economist with a hope of explaining the current hubbub concerning the depreciating value of the Rand.

On the monetary front, he explained his view on the monetary policy committee maintaining the repo rate at 5.50. “Inflation is expected to remain relatively subdued. Considering this and the downside risk to growth in Namibia, given a still fragile global economic recovery, it seems appropriate to maintain the current monetary policy stance. Certainly, credit extension is strong and can not continue unabated.”

A recent study by the Bank of Namibia shows households’ debt is high. The level including informal debt (the latter includes the debt of the unbanked) was as much as 89.6% of personal disposable income in 2011. This suggests room for further borrowing by households is becoming limited. Kamp said “I suspect that unless foreign capital inflows increase, the private sector will need to save more and (hence borrow less) especially if the government saves less due to strong government consumption spending in 2013/14.”

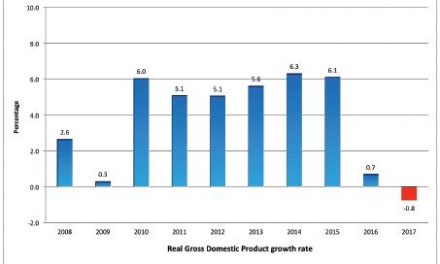

Kamp gave a brief overview of Namibia’s economy stating that it is relatively stable and that there are a few interesting focal points in the budget that highlighted the Ministry of Finance’s gameplay over the next to years. He mentioned that Namibia’s ratio of debt to GDP remains low in comparison to other countries in the world. In his view, the sharp increase in expenditure of about 19% will probably be offset by the expected decline in spending in the following to fiscal years. The tax relief for the various income groups is one of the indications that ratio of tax to GDP growth will decline over the next few years. The move which defies the usually steady correlation between the two variables could spell danger if government concurrently decreases expenditure during the 2014/2015 and 2015/2016 fiscal years. “If so, budget deficits would be larger than budgeted and government would need to borrow more than expected. That implies the ratio of government debt would go higher than expected. (The current government debt ratio is 26.3% of GDP at end fiscal year 2012/13 and is budgeted to increase to 30.7% of GDP at end 2015/16), ” explained Kamp.

In conclusion the chief economist has some cautious parting words concerning Namibia’s revenue stream. “I think the economy must be increasingly diversified, reducing the reliance on volatile mining income (and SACU transfer windfalls). The focus should be on lifting potential economic growth through measures to increase productivity growth.”