New Year’s gift for clients as Blue Bank reduces point of sale fees by 17%

As of 1 January 2019, Standard Bank’s Point of Sale fees will be reduced by 17%, allowing significant savings on transactional costs every time clients swipe to make a purchase.

As part of its pricing review, monthly management fees for pensioners were reduced to zero while interest payment on positive current account balances held by pensioners has been introduced. Additionally, the bank’s penalty-based fees on unpaid debit orders will be reduced by 50%. The normal debit order fees will remain unchanged though.

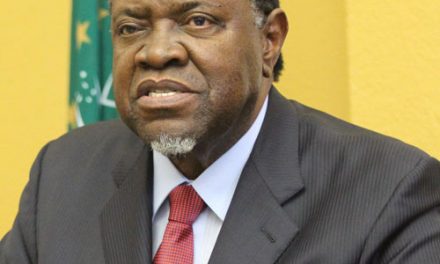

Mercia Geises, Head of Personal and Business Banking said the annual pricing review is in line with the bank’s customer-centric approach. Geises added that in order to ensure that the benefits of technological changes are passed on to their customers, business banking clients, including small and medium enterprises will now enjoy a 30% reduction in electronic transaction fees on the bank’s internet banking platform.

“We will not be increasing electronic banking fees for our retail clients on Internet Banking, Cellphone Banking and the Standard Bank App. Monthly subscription for all our electronic channels are free of charge,” said Geises.

Moreover, Standard Bank’s bundled pricing option offers unlimited electronic transactions which include domestic debit card purchases, inter-account transfers and electronic payments. Additionally, the bundle includes funeral cover to the value of N$10,000, physical impairment cover up to N$110,000 and death cover also up to N$110,000.