There is movement on the NSX. Wow! The economy is alive

A series of unprecedented events unfolded in the local index of the Namibia Stock Exchange (NSX) recently. For the first time as long as I can remember, the index actually made substantial moves, both downward an upward.

In general, the local index is widely viewed as a repetitive, static measurement of an exchange where there is little activity except for deals in JSE dual-listed shares.

For the better part of twenty years, the NSX sported to very characteristic elements. First, it was obvious from the daily charts that the overall index, comprising some 36 listed entities, is basically a shadow curve of the Johannesburg Securities Exchange All-share Index (ALSI) only on a much lower scale. Second, it was equally obvious that the local index consisting of only 10 companies, was not going anywhere but up.

In the past, it often astounded me how the local index, although very static, always incrementally moved higher and when there was a slight decrease, it was very slight, and it quickly reverted to its glacial upward pace.

Local investment managers know why this is so. It is not a secret that local share liquidity is close to zero and that secondary trading was almost unheard of. For several reasons, local investors bought local shares as they became available, and then never traded them. This was in part due to compliance issues, notably the percentage of domestic assets as prescribed by Regulation 28 of the Pension Fund Act, but also because of the very limited number of truly local assets.

In many discussions, I have shared the opinion with investment managers that there are no liquid assets in the Namibian market, and this view was corroborated by every individual without exception. In the meantime, the very limited supply and the slow pace of local growth kept local share prices more or less on an even keel and year on year movement was small. Still, the odd trades at slightly higher prices, are what kept the local index on its almost flat but ever so slightly rising trajectory.

This picture has changed somewhat over the past five years with some notable listings but the bigger picture changed very little. The local index, in essence remained static, almost flat with a small upward bias for exactly the same reasons mentioned earlier.

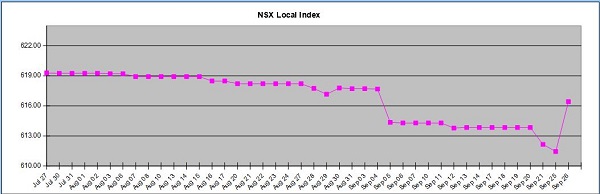

Then in August this year, I started noticing an almost innocuous change in the pattern. First the bias shifted downward, but again ever so slightly, and then on 07 August and again on 16 August, two notable downward shifts occurred before resuming the flat line, only at a lower index value around 617.8 index points. On 05 September, only three weeks ago, there was a major downward move taking away roughly 0.8% market value in a single day.

This move drew much attention in the local investment market but hardly caused a blip outside the circle that deals in listed shares on a daily basis. And then last week Friday 21 September and again on Tuesday 25 September another notable downward shift occurred, again close to 0.8% over the two trading days. (Monday was a public holiday in South Africa so no local trading)

But the market had saved the biggest surprise for this week Wednesday when the local index “jumped” by 4.7 index points, roughly an 0.75% upward move.

At first I suspected that Bidvest was the culprit but when I checked the dates, it seemed that their share price move was history. Bidvest just sat there at N$7.77 without a single trade in months.

Huge was my surprise when I realised the only shares that traded frequently and in substantial volumes were Capricorn and FirstRand. From N$16.87 on 04 September, Capricorn has gradually traded down to N$16.24 earlier this week and FirstRand followed a similar pattern from N$44.89 early in the month to N$44.00 this week.

These are not earth-shattering moves, in fact they are tiny, but it was on the days when these two shares traded in large volumes that the local index responded so significantly downward. And this week’s upward move, was again caused by a single share, Namibia Breweries Ltd where the share price moved up by only one dollar but the volume was fairly hefty so the impact on the index was out of proportion.

This local index history of the past two month is perhaps the best quantifiable indicator of exactly how very restricted the supply of local liquid assets is, and how small share price moves have a extraordinary large effect on the market when the volumes are significant.

These up and down moves have broken the stoic pattern in the local index, but they have also shown that there can be life in local trading provided there is an ample supply of tradeable stock. It also shows me that there is life in the economy and that assets are changing hands. This is a good sign.

Henceforth, I also see a promising future for local assets but then the local companies must come to market. I am not sure precisely whose responsibility that is because there are many players involved but I believe the Ministry of Finance will not waste its energy and its resources if it starts pushing the NSX more firmly as an important agent for local assets.