Africa is a continent in dire need of energy

By Laura Gil

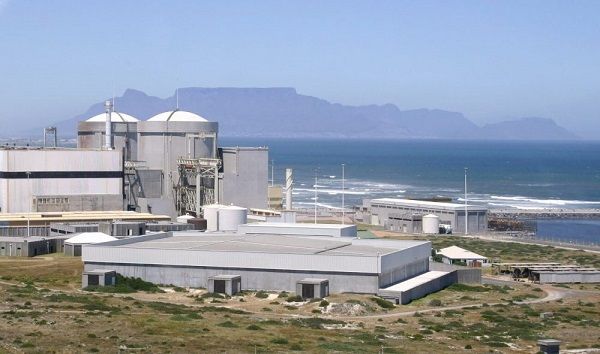

Years back, nuclear energy was a fancy option limited to the industrialized world. In due course, nuclear could be an energy source for much of Africa, where only South Africa currently has a nuclear power plant.

Governments across the continent are devising development policies to become middle-income countries in the medium term. Socioeconomic growth comes with a rise in energy demand—and a need for a reliable and sustainable energy supply.

For industrializing countries in need of a clean, reliable and cost-effective source of energy, nuclear is an attractive option.

“Africa is hungry for energy, and nuclear power could be part of the answer for an increasing number of countries,” said Mikhail Chudakov, deputy director general and head of the Department of Nuclear Energy at the International Atomic Energy Agency (IAEA), an international organisation that promotes the peaceful use of nuclear technology.

A third of the almost 30 countries currently considering nuclear power are in Africa. Egypt, Ghana, Kenya, Morocco, Niger, Nigeria and Sudan have already engaged with the IAEA to assess their readiness to embark on a nuclear programme. Algeria, Tunisia, Uganda and Zambia are also mulling the possibility of nuclear power.

“Energy is the backbone of any strong development,” said Nii Allotey, director of the Nuclear Power Institute at the Ghana Atomic Energy Commission. “And where do we get energy from? We have hydro, thermal, fossil fuels, and we have local gas—but these are dwindling. They are limited; fossil fuels could run out by 2030. And, the prices are volatile.”

For Africa, cost-effective, reliable electricity is the entry point to higher-value-added manufacturing and export-led growth.

For example, Ghana’s reserves of bauxite, the ore used to produce aluminium, are an important source of income, but for now it is exported raw. “We have a smelter, but it’s not operating at full capacity because electricity is too expensive,” Mr. Allotey said. “If we had cost-effective electricity, we would not be exporting raw bauxite but smelted bauxite at a much higher price.”

Power to the people

African governments are working to make electricity more widely accessible. Roughly 57% of the population of sub-Saharan Africa does not have access to electricity. For many, the electricity supply is characterised by frequent power outages, according to the International Energy Agency, an organisation of 30 mostly industrialised countries that have met a set of energy security criteria.

Kenya is considering nuclear to meet the demand generated by hooking up households nationwide, which is expected to contribute significantly to the 30% increase in electricity demand predicted for the country by 2030. “For a long time electrification levels were low, but the government has put in a lot of efforts towards electrifying the entire country,” said Winfred Ndubai, acting director of the Kenya Nuclear Electricity Board’s Technical Department. “Even those areas that were considered to be remote are now vibrant. Within a period of about 10 years we have moved from a 12% electrification rate to 60%.”

Is Africa ready for nuclear?

“Going nuclear is not something that happens from one day to the next. From the moment a country initiates a nuclear power programme until the first unit becomes operative, years could pass,” said Milko Kovachev, head of the IAEA’s Nuclear Infrastructure Development Section, which works with countries new to nuclear power.

“Creating the necessary nuclear infrastructure and building the first nuclear power plant will take at least 10 to 15 years. A successful nuclear power programme requires broad political and popular support and a national commitment of at least 100 years,” Kovachev added.

This includes committing to the entire life cycle of a power plant, from construction through electricity generation and, finally, decommissioning.

In addition to time, there is the issue of costs. Governments and private operators need to make a considerable investment that includes projected waste management and decommissioning costs. Mr Kovachev pointed out that “the government’s investment to develop the necessary infrastructure is modest relative to the cost of the first nuclear power plant. But [it] is still in the order of hundreds of millions of dollars.”

Financing nuclear energy

Without proper financing, nuclear is not an option. “Most countries in Africa will find it difficult to invest this amount of money in a nuclear power project,” Kovachev said. “But there are financing mechanisms like, for instance, from export agencies of vendor countries. Tapping into a reliable, carbon-free supply of energy when vendors are offering to fund it can make sense for several countries in Africa.”

Another aspect to consider is the burden on the electrical grid system of a country. For any country to safely introduce nuclear energy, the IAEA recommends that its grid capacity be around ten times the capacity of its planned nuclear power plant. For example, a country should have a capacity of 10,000 megawatts already in place to generate 1,000 megawatts from nuclear power.

Few countries in Africa currently have a grid of this capacity. “In Kenya, our installed capacity is 2,400 megawatts—too small for conventional, large nuclear power plants,” Ms Ndubai said. “The grid would need to increase to accommodate a large unit, or, alternatively, other, smaller nuclear power plant options would need to be explored.”

One option is to invest in small modular reactors (SMRs), which are among the most promising emerging technologies in nuclear power. SMRs produce electric power up to 300 megawatts per unit, or around half of a traditional reactor and their major components can be manufactured in a factory setting and transported to sites for ease of construction.

“One of the things we are very clear about in terms of introducing nuclear power is that we do not want to invest in a first-of-a-kind technology,” Ndubai said. “As much as SMRs represent an opportunity for us, we would want them to be built and tested elsewhere before introducing them in our country.”

Joining a regional grid is another option. “Historically, it has been possible to share a common grid between countries,” Kovachev continued. “But, of course, this requires regional dialogue.” One example of such a scheme is the West African Power Pool, created to integrate national power systems in the Economic Community of West African States into a unified regional electricity market.

Another factor militating against a headlong rush into nuclear power is popular rejection of projects that are costly and hard to finance. Also, countries are wary that in the event of a nuclear power plant accident, released radioactive material will harm the environment and lives.

IAEA assistance

While the IAEA does not influence a country’s decision about whether to add nuclear power to its energy mix, the organisation provides technical expertise and other pertinent information about safe, secure and sustainable use to countries that opt for nuclear energy.

Safety and security are key considerations in the IAEA Milestones Approach, a phased method created to assist countries that are assessing their readiness to embark on a nuclear power programme. The approach helps them consider aspects such as the legal framework, nuclear safety, security, radiation protection, environmental protection and radioactive waste management.

“Many, many people ask the question: Why nuclear?” Mr Allotey asked. “To me, it’s not about nuclear being an option. It is about energy being an option. Do you, as a country, need energy? And the simple answer is yes. So if you need energy, you need to find cost-effective electricity that is clean and reliable.”

“With a rapidly expanding population and plans to grow our economies, we need to work within these constraints. We are a continent that is in dire need of energy,” he concluded.