Local bank slashes monthly account management fees to cushion clients

Bank Windhoek announced its revised annual fees structure, which aligns with industry standards and other macro-economic factors such as the inflation rate, effective 1 July.

The bank in a statement said the new fee structures will make banking more affordable and bring additional value to the customers.

According to Bank Windhoek’s managing director, Baronice Hans the bank will decrease it’s monthly account management fees for Transaction and all Cheque Accounts.

In addition to this decrease, she said the Bank will be adding free Legal cover to the value of N$30, 000 to all these accounts, as well as free Life Cover to the value of N$30,000 to all Cheque Accounts.

“In delivering these services to its clients, Bank Windhoek incurs fixed and variable costs such as operational and staff costs, the cost of expanding and upgrading our branch and ATM infrastructure across Namibia, the cost of transporting and safeguarding cash and continuous investments in our systems to ensure that our service delivery to customers improves continuously”, she said.

Hans said as a co-creator of the Namibian Code of Banking Practice, Bank Windhoek embraces the principle of transparency when it comes to fees for products and services and is therefore committed to fully disclose these.

The Bank also recently successfully launched their Women in Business financial solution which is aimed at women entrepreneurs. Amongst the benefits in this product is the option to choose to have a Bundled Fee or a Pay As You Go Fee when using the Women in Business Current Account.

“We are also proud to offer competitive Point-of-Sale purchase (transaction) fees in the market and we would like to encourage customers to make use of their debit cards for transactions which is much safer than carrying cash,” Hans added.

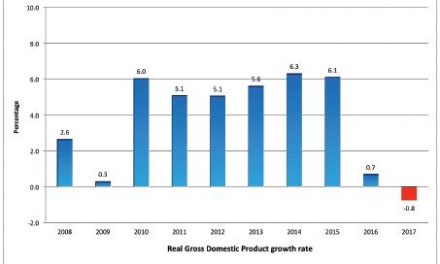

Meanwhile Hans reassured clients that the bank also took the current economic conditions in account and have fairly priced the products and services.