Crypto trades driven purely by sentiment – Warwick study could not find any correlation to fundamentals

New research studying the weekly trading patterns of 14 of the largest cryptocurrencies, including Bitcoin, from April 2016 to September 2017 found no correlation with any economic indicators that investors would base decisions on or with commodities.

In a working paper titled “Cryptocurrencies as an Asset Class: An Empirical Assessment,” Professor Daniele Bianchi of Warwick Business School in the United Kingdom, concluded that pricing is entirely influenced by past returns and the hype and emotion of investors as they watch the price climb or drop.

The stunning rise in the price of Bitcoin, hitting US$17,500 last December as it increased by more than 500% in 2017, has seen investors flood to cryptocurrencies with futures markets even being set up by exchanges.

“There is research showing limited similarities between Bitcoin and gold, but looking across the 14 biggest cryptocurrencies the high volatility of their price means that they can hardly be seen as a reliable savings instrument in the short-term, let alone the long or medium term,” said Dr Bianchi.

“These are not like normal currencies where a country’s economy will influence the price. Instead they share similarities to investing in an equity from a high-tech firm. As a matter of fact, most of these cryptocurrencies come to existence through unregulated crowd sales similar to IPOs, the so-called Initial Coin Offering or ICO.”

“As a result, the market for cryptocurrencies may look similar to the dot.com bubble at the end of the 1990s, and it may be that only a handful of them survive, so for investors it is like choosing who will be today’s Amazon.”

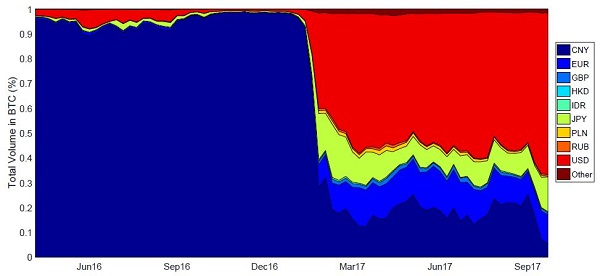

Despite the vast number of cryptocurrencies being produced Dr Bianchi found Bitcoin transactions overwhelmingly dominated cryptocurrency trading, accounting for more than 80% of all transactions until early 2017. However, in the ensuing months to the end of the sample period in September 2017, Bitcoin transactions declined to about 40%, making way for other currencies most notably Ethereum.

By September 2017 the market capitalisation of Bitcoin and Ethereum was about US$65 billion and US$28 billion, respectively.

That is the size of a large cap stock in the US yet the end-of-sample median market capitalisation across the 14 cryptocurrencies, which made up 85% of the total market capitalisation of cryptos, was about US$850 million, which is more the size of a small cap stock.

It also found that up to early 2017 almost all of the trading in Bitcoin was done in Chinese Yuan before the Chinese Government embarked on shutting down the exchange platforms. This is evidenced by the accompanying graph clearly showing the large drop in Yuan-denominated deals.

Dr Bianchi added: “Although the market for cryptocurrencies is growing massively, it is still largely dominated by a few players.

“Cryptocurrencies have more in common with an equity investment in a company than an investment in a traditional currency. For instance, holding Bitcoin can be ultimately seen as an investment in the blockchain technology rather than a simple speculation.

“Having said that, portfolio returns are highly volatile thus negating the chances of using the popular momentum strategy for trading in cryptocurrencies. Although there is some predictive power of past performance for future returns, the profitability of a momentum strategy in cryptocurrency markets is significant only in the very short term.”