Growing demand and price spur Australian cobalt explorer to seek NSX dual listing

Demand pressure by the battery industry has driven the price of cobalt from US$20,000 per tonne in 2012 to US$91,000 per tonne earlier this year. This four and a half fold increase in the price of the commodity has spurred a flurry of exploration and market activity. The first of it to hit Namibia arrived this week in the form of a dual-listing of Australian explorer, Celsius Resources Ltd.

Timed to coincide with the Mining Expo, Celsius Resources dual-listed on the Namibian Stock Exchange (NSX) on Tuesday, a day ahead of the conference. The company’s primary listing is on the Australian Stock Exchange.

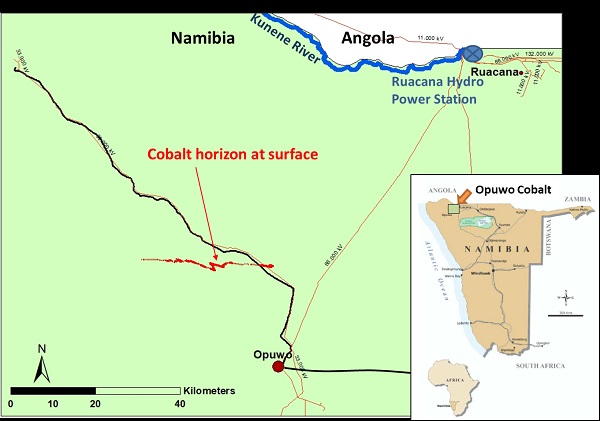

Celsius Resources is working with its local partner, Gecko Mining, on a surface cobalt copper mineralisation discovered in 2012 by Dr Rainer Ellmies. This ridge has similarities to cobalt copper deposits in the Zambian copper belt. All the local exploration work is done by Gecko.

Known as the Opuwo project for its proximity to the administrative capital of the Kunene Region, momentum for the dual-listing picked up earlier this month when Celsius Resources announced a maiden JORC-compliant mineral resource after assaying the results of 128 holes drilled during last year. The resource modelling and estimation has been done by independent consultants, DMT Kai Batla.

Celsius said it has spent roughly N$50 million in exploration costs to date, an investment which bagged the company 95% of the Opuwo Project. The other 5% is held by the Robben Island Political Prisoners Trust. The largest shareholder in the Australian entity is local exploration partner, Gecko Namibia with 8.4% or just over 50 million shares.

Last week Celsius announced it will finalise its first scoping study by the end of June this year. “A significant amount of metallurgical test work has been done on the ore from the Opuwo Cobalt Project and further optimisation work is ongoing as part of the scoping study. Additionally, work has commenced on evaluating mine design options to establish the best mining methods for this deposit. The intention is to commence with a pre-feasibility study by mid-2018. During this period, infill drilling and intense metallurgical test work will enhance the mineral resource,” stated Celsius when announcing their dual-listing on the NSX.

“Cobalt has a diverse range of metallurgical and chemical uses ranging from aircraft engines to rechargeable batteries. Strong demand for rechargeable batteries has been the biggest growth driver for cobalt consumption, and demand is forecast to continue to increase as batteries are increasingly adopted in households and vehicles,” stated Celsius.

“Furthermore, automotive related demand for cobalt containing battery materials is expected to rapidly increase in coming years with increasing sales of plug-in hybrid and fully electric vehicles,” the company said.

Commodities analysts estimate that the cobalt market first registered a deficit in 2016, and that demand will continue to grow. “As a result of the industrial importance of cobalt and the concentration of supply, cobalt is classed as a strategic mineral by the US Geological Survey and as a critical raw material by the EU.”

On the prospects for cobalt mining at Opuwo, Celsius stated that the mineralisation appears within a low-grade metamorphic siltstone-shale-carbonate succession within the upper Ombombo Formation of the Neoproterozoic Damaran group. It was traced at surface over a strike length of about 32 km.” The highest grade ore has been found in a four to six metre zone in a 15 km section in the central part of the ridge.

“The cobalt copper zinc mineralisation at the Opuwo project contains three main ore minerals: linnaeite (Co3S4), chalcopyrite (CuFeS2) and sphalerite (ZnS). This simple mineralogy is very favourable for conventional processing techniques,” Celsius said adding that ultimately, it wants to produce cobalt sulphate and copper metal in Namibia.

A month ago, Reuters reported that Celsius Resources wants it Opuwo cobalt mine up and producing by 2020.

All cobalt exploration in the Kunene Region is carried out on behalf of Celsius Resources by Gecko Namibia. Gecko is also the largest shareholders in the Australian-listed minor.