Bank Windhoek launches Visa Credit Cards which can be used globally

Bank Windhoek recently introduced its Gold and Platinum Visa Credit Cards, which can now be used globally.

The Visa Gold Credit Card is targeted at Selekt 2000 Account holders while Selekt 5000 and Selekt 10,000 customers have access to the Visa Platinum Credit Card. Both credit cards can be used globally.

The Visa Platinum and Visa Gold Credit Cards offer a 55 days interest free period on all transactions and free POS and e-commerce (online) transactions.

“Customers also receive Fraud Claims Cover and Travel Insurance on both cards at no extra cost,” said Bank Windhoek’s Executive Officer of Retail Banking Services, Chris Matthee.

Potential customers are required to have a Bank Windhoek Current or Transactional Account to qualify for this facility. Bank Windhoek’s Visa Gold and Platinum Credit Cards are linked to these Current or Transactional Accounts and can thus be viewed and managed via Internet Banking and the Mobile App

“This is a long sought-after milestone for Bank Windhoek. The new Bank Windhoek Visa Gold and Platinum Credit Cards are our customers’ pass to risk-free online transacting and single-view management of accounts on the Bank’s electronic banking channels, including our Mobile App and iBank. Most importantly, these Bank Windhoek Visa Gold and Platinum Credit Cards offer our customers the lifestyle they deserve,” said Matthee.

Other features of the cards include: Free balance enquiries at Bank Windhoek ATMs; free 24 hour access via the Bank Windhoek Mobile App and Internet Banking; instant transfers between your credit card and other Bank Windhoek accounts; free SMS notifications; attractive interest rates on a positive balance and sending an EasyWallet from your Credit Card account, using Internet Banking, our Mobile App and Cellphone Banking

“In terms of security, the cards are fitted with a chip, which offers better security and has a sleek, minimalistic and modern design,” added Matthee.

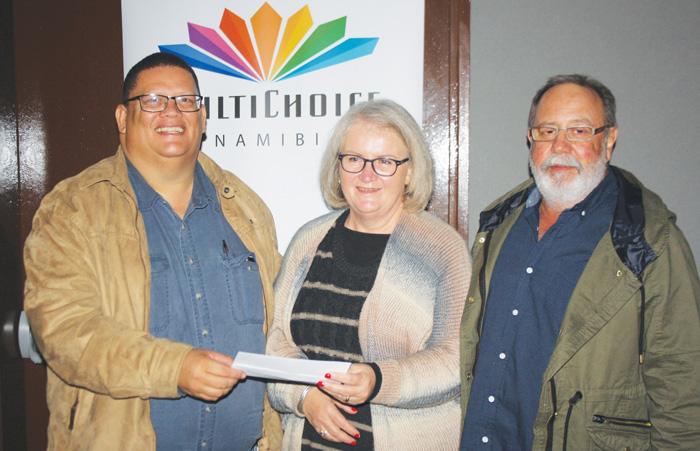

Caption: Bank Windhoek’s Executive Officer of Retail Banking Services, Chris Matthee said customers who wish to apply or those that might need more information, visit any Bank Windhoek Branch or Agency or visit www.bankwindhoek.com.na.