Broad array of indicators continue sending mixed signals

While it can not be disputed that banking liquidity in the first half of March continued the somewhat depressed trend of January and February, it is also noticeable that the banking sector ended March on a significantly more positive level.

Last week, Namibian banks’ combined local and South African liquidity positions ended the month a tad short of N$3 billion. The position quickly changed for the better this week reaching almost N$3.7 billion, and that shortly after month-end.

Some analysts argue that the N$800 million Bank of Namibia bills taken up by local banks are an indication of “mild” liquidity stress but this has to be viewed against a zero demand for BoN bills up to the last week of March. It was only on 26 March that local banks required the relatively modest liquidity boost from the central bank.

In any case, the BoN bills are miles away from last year’s trend and this week the outstanding bills also followed a positive trend, abruptly dropping to N$550 million by Thursday, sending a signal that the mild liquidity stress is indeed very mild.

Similarly, outstanding Repos have dropped from just over N$700 million at the beginning of March to just under N$240 million by the end of the month. Repos, contrary to BoN bills this week had a slight upward move, increasing to N$287 million but still far away of the demand in the first semester of 2017.

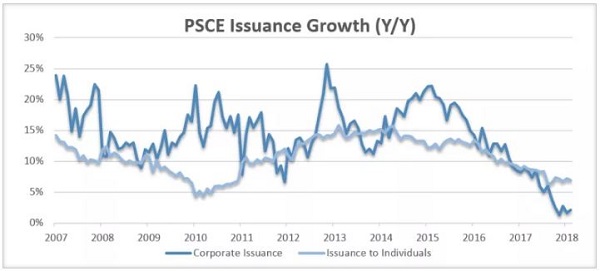

The sticky Private Sector Credit Extension figures, although still very disappointing, indicates some consolidation. At the end of February, there was a slight uptick in PSCE compared to January but still less than the depressed growth rate of a year ago when it was already catastrophic. But as always, the overall picture tends to be misleading and the significance must be found in the detail. There is a marked difference in the demand for credit by commercial entities compared to private households.

During 2017, the growth in household credit outpaced the demand from corporates as shown by the strong growth in overdraft lending to private individuals. Businesses, however, required less and less credit, and after a small surge in overdraft lending at the beginning of 2017, this component receded for the rest of the year. The relationship between these two categories of borrowers show that individuals, and by definition, households, were under stress while corporates gradually reduced their exposure.

This has now turned around significantly with private individuals contributing only 0.6% in credit growth while credit to corporate clients jumped almost 2% from January to February.

Looking at long-term trends, I do not believe that the banking liquidity has decreased to stress levels, far from it. Compared to the first three months of 2017, this year saw a positive liquidity position throughout. Granted, current liquidity is not as comfortable as around September last year, but not nearly as constrained as at the beginning of 2017 when overall liquidity was mostly negative up to 09 May. We have not seen a single day of negative banking liquidity since.

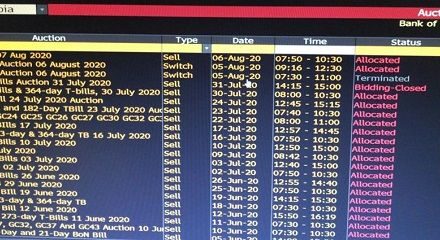

A further indication of robust liquidity year on year, comes from the sterling performance of government debt auctions although it must be pointed out that short-term instruments are far more popular than longer-dated paper, and that there is almost zero demand for any bonds with maturities beyond 2030.

Thursday’s 364-day Treasury Bill tender was again more than twice oversubscribed, comfortably financing the government’s current requirement at fairly favourable yields between 8.12% and 8.37%. This is indicative of ample liquidity and if indeed, there is “mild” stress in the banking system, I suspect it would be with only one big bank, and perhaps one of the small new entrants.

Overall the signals I see show more than sufficient liquidity for this time of the year and mountains more than this time last year.

It is also noticeable that growth in the money supply has come down from more than 9% year on year to 6.5% in March but this has much to do with the technicalities of trade financing and of Bank of Namibia investments. It has little to do with the amount of money that goes through local banks on any given day. Again, as a comparison, at the end of 2016 and early 2017, money supply growth was a paltry 4.5%.

It is perhaps premature to premise expectations for the rest of the year on the performance of only one quarter, but in general, I sense that most of the financial consolidation has already taken place. I am not predicting a sudden recovery in 2018, it is far to early for that, but I can safely state that the majority of the available indicators show a far more stable first quarter than a year ago.

Graph courtesy of IJG Research – Ed.